Securing a business line of credit can be a valuable financial tool for businesses looking to manage cash flow or finance short-term expenses. However, understanding the requirements associated with obtaining a business line of credit is essential. In this blog post, we will explore the factual data on business line of credit requirements, including the necessary qualifications, documentation, and steps involved in the application process. By familiarizing yourself with these requirements, you can increase your chances of successfully obtaining a business line of credit and leveraging it to support your business goals.

I. Introduction to Business Line of Credit

What is a Business Line of Credit?

A business line of credit is a revolving loan that provides a business with access to a predetermined amount of capital. Unlike a traditional loan, where you receive a lump sum of money upfront, a business line of credit allows you to borrow and repay funds as needed, up to your approved credit limit. It provides flexibility and can be used for a variety of purposes, such as managing cash flow, covering unexpected expenses, or taking advantage of growth opportunities.

Here's a quick overview of the benefits and uses of a business line of credit:

- Flexibility: A business line of credit provides flexibility in terms of when and how you use the funds. You can borrow and repay the funds as needed, making it a useful tool for managing cash flow fluctuations.

- Working Capital: It can help you cover day-to-day expenses, such as payroll or inventory purchases, ensuring that your business operations run smoothly.

- Emergency Funding: Having access to a line of credit can provide a safety net in case of unexpected expenses or emergencies, giving you peace of mind.

- Growth Opportunities: A business line of credit can be used to take advantage of growth opportunities, such as expanding your product line, launching a new marketing campaign, or investing in equipment or technology upgrades.

- Improving Credit: By using a business line of credit responsibly and making timely repayments, you can improve your credit score and build a positive credit history.

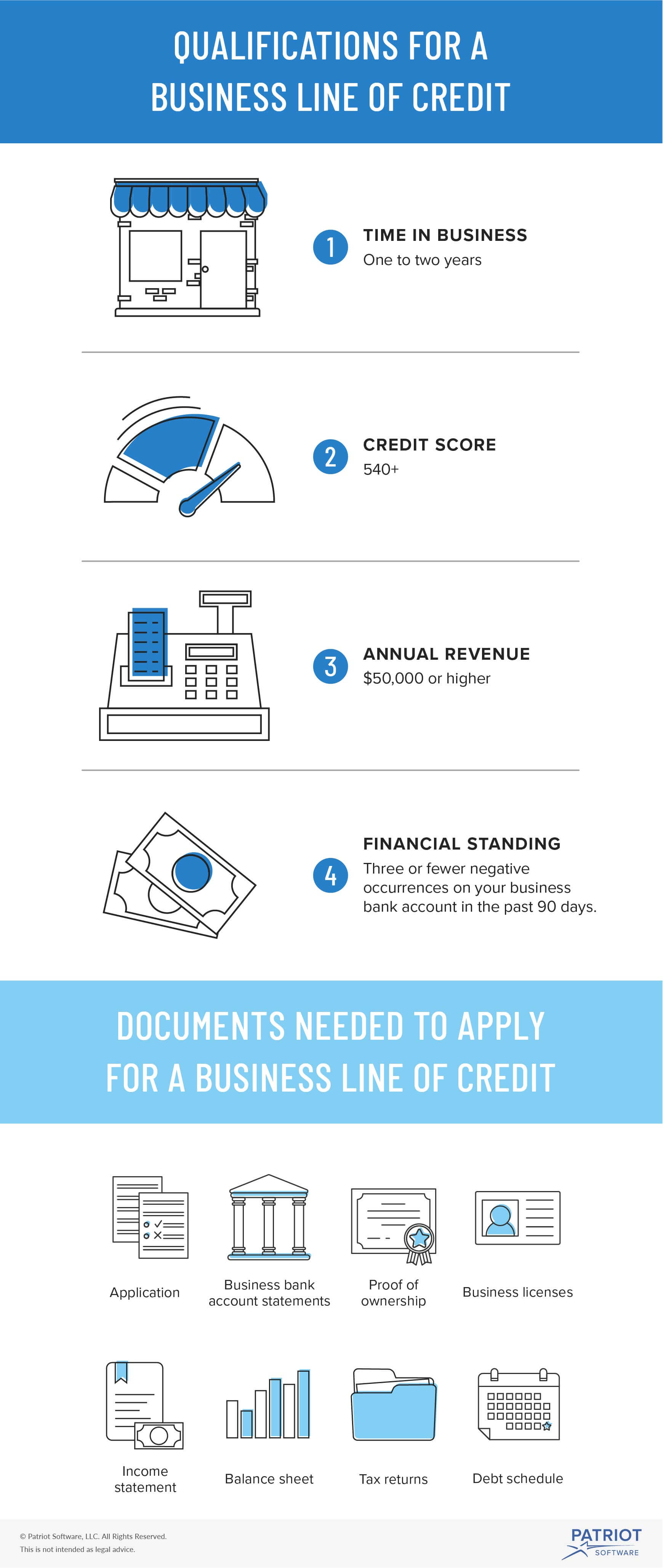

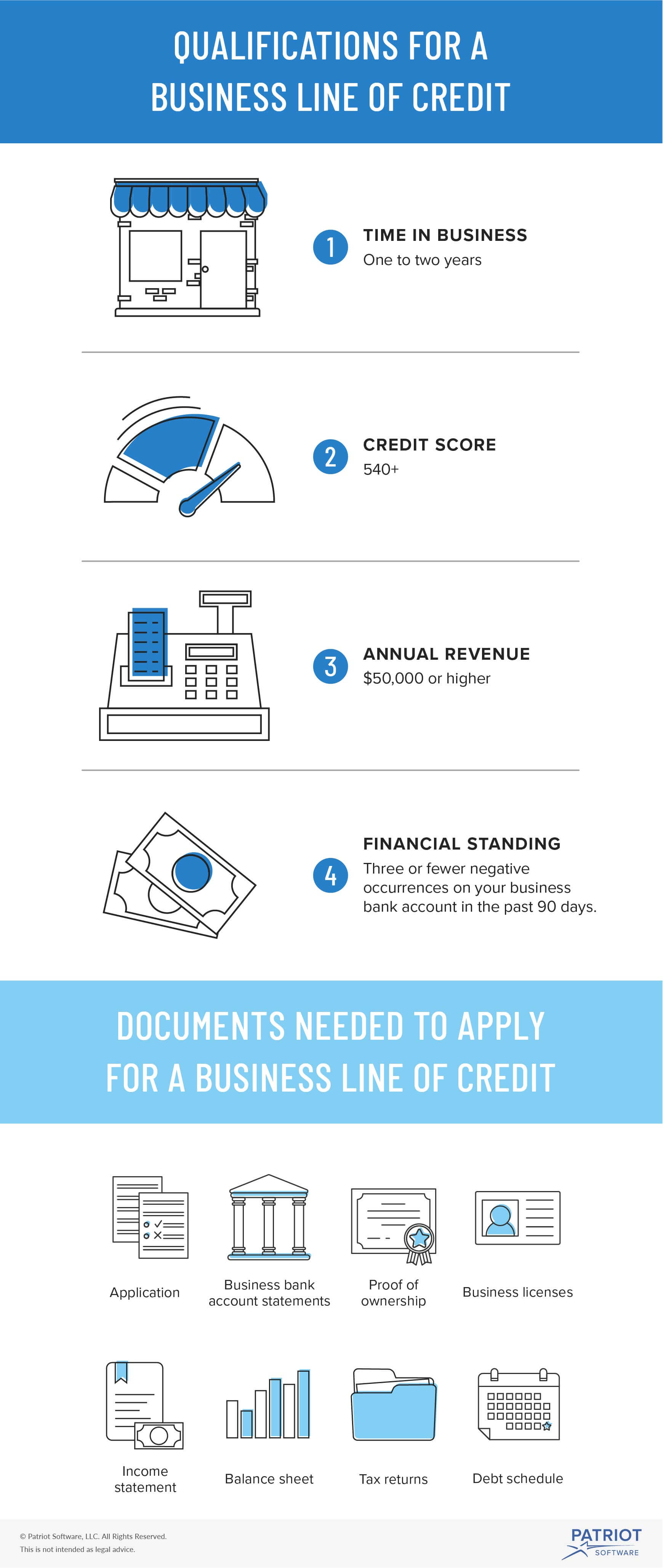

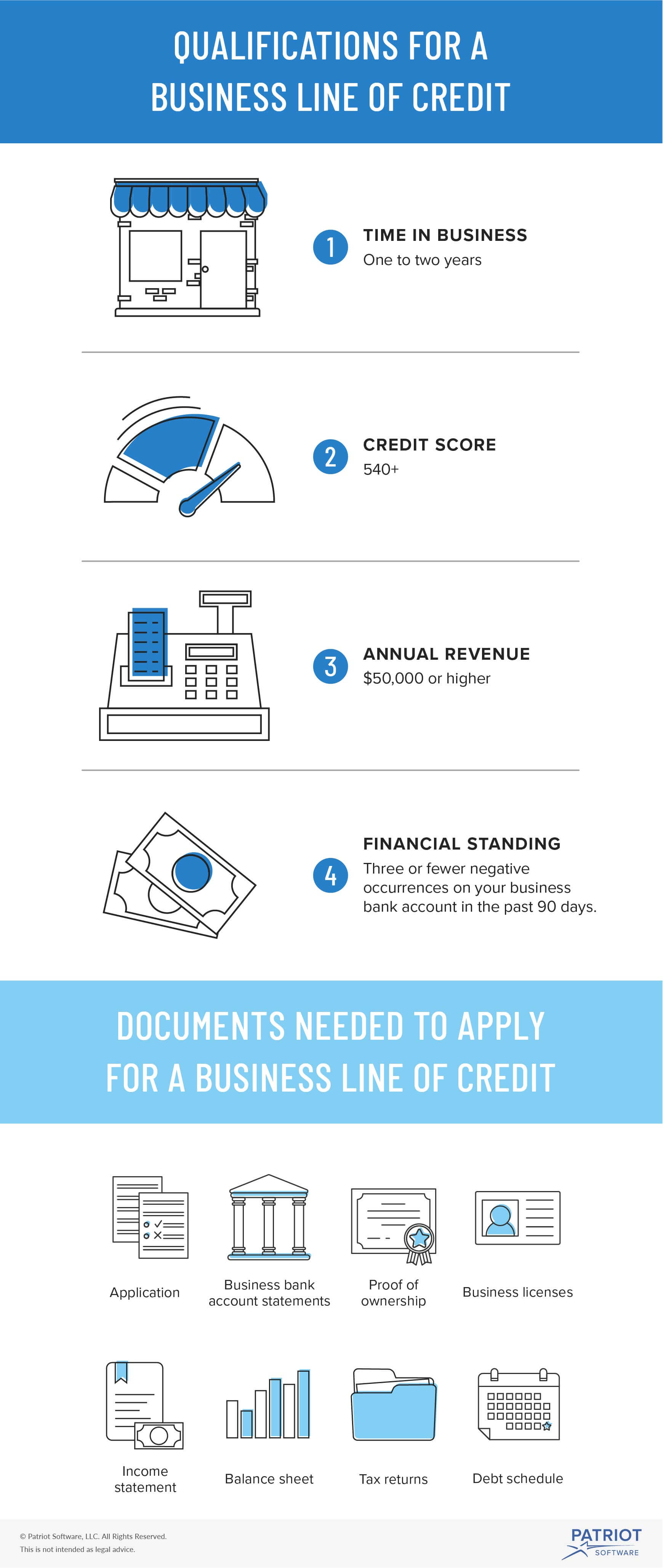

While the specific requirements for a business line of credit may vary depending on the lender, there are some common factors that lenders consider when evaluating your eligibility:

Credit Score and History: Lenders typically look at your personal and business credit scores to assess your creditworthiness. A strong credit score demonstrates that you have a history of responsible borrowing and repayment.

Time in Business: Lenders often prefer to work with established businesses. The length of time your business has been operating can have an impact on your eligibility for a business line of credit.

Annual Revenue: Lenders also consider your business's annual revenue to assess your ability to repay the borrowed funds. A steady and consistent revenue stream can increase your chances of qualifying for a higher credit limit.

Financial Statements: Lenders may require you to provide financial statements, such as income statements, balance sheets, and cash flow statements, to assess your business's financial health and ability to repay the line of credit.

Other Documents and Information: Lenders may also ask for additional documentation, such as business licenses, tax returns, bank statements, and legal documents, to verify your business's legitimacy and financial standing.

It's important to note that each lender may have specific requirements and criteria for approving a business line of credit. Therefore, it's advisable to research and compare different lenders to find one that aligns with your business's financial situation and goals.

Benefits and Uses of a Business Line of Credit

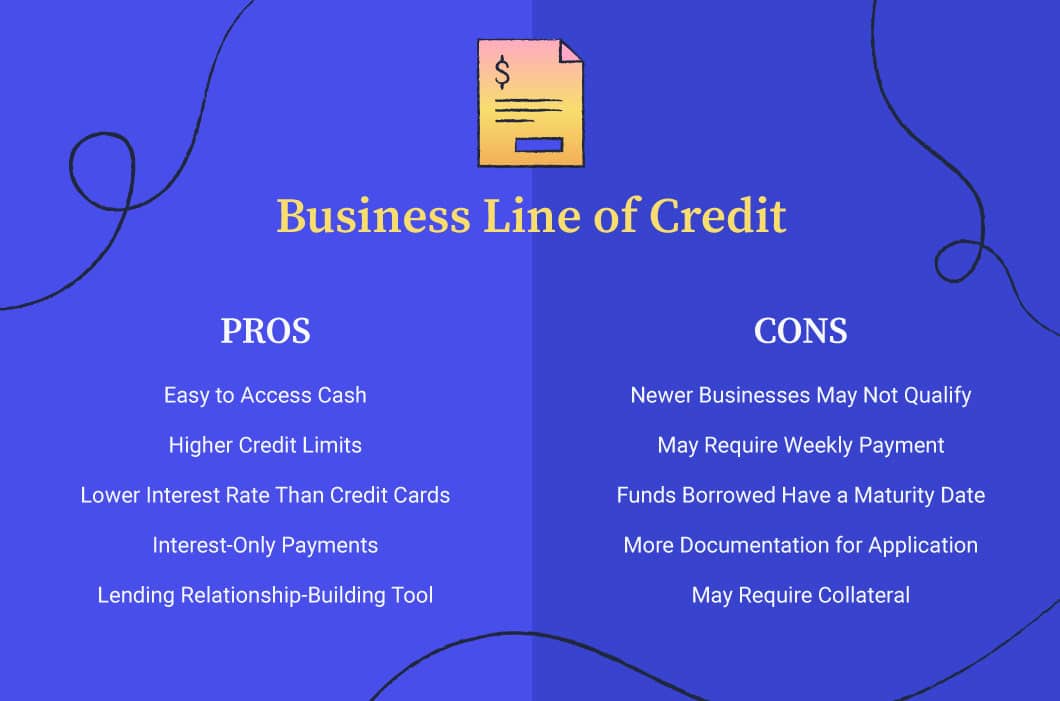

A business line of credit offers various benefits and can be utilized for a variety of purposes. Some of the key benefits of a business line of credit include:

Flexibility: A business line of credit provides a revolving credit limit, allowing business owners to borrow and repay funds as needed. This flexibility makes it an ideal financing option for managing cash flow fluctuations, unexpected expenses, or taking advantage of growth opportunities.

Cost-saving: Unlike a traditional business loan where interest is charged on the entire loan amount, a line of credit only charges interest on the funds actually used. This can result in cost savings for businesses, as they only pay interest on the amount borrowed.

Access to Capital: Having a business line of credit in place provides access to readily available capital whenever it is needed. This can help businesses seize time-sensitive opportunities, cover unexpected expenses, or bridge gaps in cash flow.

Building Credit: Consistently using and repaying a business line of credit can help establish and build business credit. This can improve a business's creditworthiness and open doors to more favorable financing options in the future.

Some common uses of a business line of credit include:

Managing Cash Flow: A line of credit can help smooth out cash flow fluctuations caused by factors such as seasonality or delayed customer payments.

Inventory Purchases: Businesses can utilize a line of credit to purchase inventory and meet customer demand without depleting their working capital.

Equipment or Technology Upgrades: Businesses can finance the purchase of new equipment or technology to enhance productivity and maintain a competitive edge.

Marketing and Advertising: A line of credit can be used to fund marketing and advertising campaigns to attract new customers and drive business growth.

Business Expansion: Whether it's opening a new location, hiring additional staff, or entering new markets, a line of credit can provide the necessary funds to support business growth initiatives.

Overall, a business line of credit offers the flexibility and financial support that can help businesses effectively manage their operations, seize growth opportunities, and navigate through challenging times.

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

II. Credit Score and History

Importance of Credit Score and History

Having a good credit score and credit history is crucial when applying for a business line of credit. Lenders use these factors to assess your creditworthiness and determine the terms and conditions of the loan. A high credit score demonstrates a history of responsible financial behavior and makes you more attractive to lenders. It indicates that you are likely to repay the loan in a timely manner. Additionally, lenders may also consider your credit history, including any past bankruptcies or delinquencies. A positive credit history indicates that you have successfully managed your finances in the past, which increases your chances of securing a business line of credit.

To summarize, here are the key points regarding the importance of credit score and history when applying for a business line of credit:

- Lenders use your credit score and credit history to assess your creditworthiness.

- A high credit score demonstrates responsible financial behavior and increases your chances of securing a loan.

- Positive credit history indicates that you have successfully managed your finances in the past.

- A good credit score and credit history can result in better loan terms and conditions.

Minimum Credit Score for Business Line of Credit

The minimum credit score required to qualify for a business line of credit can vary depending on the lender. However, a good credit score is generally considered to be around 680 or higher. Lenders use credit scores as an indicator of a borrower's creditworthiness and ability to repay the borrowed funds.

Having a higher credit score can increase your chances of securing a business line of credit and may also give you access to better terms and lower interest rates. It shows lenders that you have a history of responsibly managing your credit obligations.

It's important to note that while credit scores are a significant factor in the approval process, they are not the sole determining factor. Lenders also consider other factors such as your business's financial health, revenue, and time in business.

Maintaining a strong credit score by paying bills on time, keeping credit utilization low, and managing your finances responsibly can help you qualify for a business line of credit with favorable terms and conditions.

Here's a quick summary of the minimum credit score requirements for a business line of credit:

- Good credit is generally considered to be around 680 or higher.

- Higher credit scores increase your chances of approval and better terms.

- Lenders consider credit scores along with other factors such as financial health, revenue, and time in business.

III. Time in Business

Why Time in Business Matters

When applying for a business line of credit, the amount of time your business has been operating can greatly impact your approval chances. Lenders typically prefer to work with businesses that have a proven track record and stability. Time in business is an important factor because it demonstrates that your business has weathered the initial challenges and is more likely to have a steady cash flow to repay the credit. Lenders usually require a minimum amount of time in business to qualify for a business line of credit.

Here's a breakdown of how time in business can affect your eligibility for a business line of credit:

New business (Less than 1 year): If your business is relatively new, lenders may view it as a higher risk. Many lenders require a minimum of 1 year in business before considering an application for a business line of credit.

Established business (1-2 years): Some lenders may consider businesses that have been operating for at least 1-2 years. However, the longer your business has been in operation, the more favorable your chances of approval.

Seasoned business (3+ years): Businesses with a solid track record of 3 or more years in operation generally have higher chances of qualifying for a business line of credit. Lenders see them as more stable and less risky.

In general, the longer your business has been operating, the more likely you are to meet the time in business requirements and qualify for a business line of credit. It demonstrates stability, reliability, and the ability to generate consistent revenue. However, it's essential to remember that different lenders may have different requirements, so it's important to research and find a lender that aligns with your business's time in operation.

Minimum Time in Business for Business Line of Credit

When applying for a business line of credit, one important requirement to consider is the minimum time in business. Lenders typically look for a track record of stability and success before granting a line of credit. While the specific requirements can vary among lenders, a general guideline is that businesses should have been in operation for at least six months to two years.

The minimum time in business requirement serves as a measure of the business's viability and ability to generate consistent revenue. Lenders want to ensure that the business has a proven track record and is not just starting out or experiencing significant fluctuations in income.

Having a longer time in business can also demonstrate the business owner's ability to manage and sustain a successful operation. It reassures lenders that the business has overcome the initial challenges of starting up and has established a stable foundation.

It's important to note that meeting the minimum time in business requirement is just one factor that lenders consider when evaluating a business's creditworthiness. Other factors, such as credit score, annual revenue, and financial statements, also play a significant role in the approval process. Businesses should be prepared to provide the necessary documentation and information to support their application.

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

IV. Annual Revenue

How Annual Revenue Affects Business Line of Credit

The amount of annual revenue your business generates plays a significant role in determining the eligibility and size of a business line of credit. Lenders typically use annual revenue as an indicator of your business's financial stability and ability to repay the credit. Higher annual revenue indicates that your business is generating sufficient income to cover loan repayments, making it more likely to qualify for a larger line of credit. However, the specific minimum annual revenue requirements can vary depending on the lender and the type of business line of credit you are seeking.

Here's a list of potential annual revenue requirements for different types of business lines of credit:

- Traditional banks: Typically, traditional banks have higher annual revenue requirements, starting at around $250,000 to $500,000 and can go up to several million dollars.

- Online lenders: Online lenders may have lower annual revenue requirements, often starting at around $50,000 or less.

- Small business administration (SBA) loans: For SBA loans, the annual revenue requirements can vary depending on the specific loan program and lender. Generally, SBA loans are designed for small businesses with annual revenues of up to $5 million or more.

It's important to note that meeting the minimum annual revenue requirement does not guarantee approval for a business line of credit. Lenders also consider factors such as credit score, time in business, and the overall financial health of your business.

Minimum Annual Revenue Requirements

When applying for a business line of credit, one of the requirements that lenders often consider is the minimum annual revenue. This is the amount of money your business generates in a year, and it helps lenders assess your ability to repay the credit line.

The minimum annual revenue requirement can vary depending on the lender and the type of line of credit you're applying for. Generally, lenders prefer to work with businesses that have a steady and sufficient revenue stream to ensure that they can meet their financial obligations.

Here's a general overview of the minimum annual revenue requirements for different types of business lines of credit:

| Type of Business Line of Credit | Minimum Annual Revenue Requirement |

|---|---|

| Traditional Unsecured Line of Credit | Typically requires at least $50,000 - $100,000 in annual revenue |

| Asset-Based Line of Credit | Often requires a minimum annual revenue of $250,000 - $500,000 or more |

| Invoice Financing | Usually requires a minimum annual revenue of $100,000 - $250,000 or more |

| Merchant Cash Advance | Typically requires a minimum monthly credit/debit card sales of $5,000 - $10,000 |

It's important to note that these are general guidelines, and different lenders may have their own specific requirements. Additionally, some lenders may focus more on factors like credit score and industry stability rather than strictly adhering to a minimum revenue threshold.

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-loan-and-line-credit-v2-c8a910fad66a476db1a4c013517eefbb.jpg)

V. Financial Statements and Documentation

Types of Financial Statements Required

When applying for a business line of credit, lenders typically require certain financial statements to assess the financial health and stability of your business. The specific types of financial statements required may vary depending on the lender, but commonly requested statements include:

- Balance Sheet: This statement provides a snapshot of your business's financial position, showing assets, liabilities, and owner's equity at a specific point in time.

- Income Statement: Also known as a profit and loss statement, this document summarizes your business's revenue, expenses, and net income over a specific period.

- Cash Flow Statement: This statement tracks the flow of cash in and out of your business, showing how changes in operating, investing, and financing activities affect your cash position.

- Tax Returns: Lenders may request copies of your business's tax returns, typically for the past two or three years, to verify revenue, expenses, and profitability.

- Bank Statements: Providing recent bank statements can demonstrate your business's cash flow and help lenders assess your ability to repay the line of credit.

- Financial Projections: Some lenders may require you to provide projected financial statements, such as a pro forma balance sheet or income statement, to evaluate the future performance of your business.

It's important to prepare these financial statements in a clear and organized manner, ensuring they accurately represent your business's financial situation. By providing these documents, you can give lenders the necessary information to evaluate your creditworthiness and make an informed decision about granting you a business line of credit.

Documents and Information Needed for Business Line of Credit

When applying for a business line of credit, you will need to provide specific documents and information to the lender. Here are some commonly required documents:

Business financial statements: This includes income statements, balance sheets, and cash flow statements. These statements provide a snapshot of your business's financial health and help lenders assess your creditworthiness.

Personal financial statements: Lenders may also ask for personal financial statements, especially if you are a small business owner or a sole proprietor. These statements provide information about your personal assets, liabilities, and net worth.

Business tax returns: Lenders often request copies of your business tax returns from the past two to three years. These documents help assess your business's financial stability and profitability.

Personal tax returns: In some cases, lenders may also ask for your personal tax returns to get a comprehensive overview of your financial situation.

Business plan: A well-written business plan can demonstrate your company's growth potential and help lenders understand your long-term goals and strategies.

Business bank statements: Lenders may require several months' worth of business bank statements to assess your cash flow and financial stability.

Legal documents: This includes your business's articles of incorporation, partnership agreements, operating agreements, or any other legal documents that prove your business's legal structure.

Personal identification: Lenders will typically ask for personal identification documents such as driver's license or passport.

Other financial information: Depending on the lender, they may request additional financial information, such as accounts receivable and accounts payable reports, proof of collateral, or documentation for outstanding loans or debts.

Ensure you have these documents and information readily available when applying for a business line of credit to streamline the application process and increase your chances of approval.

Comments

Post a Comment