Running a successful business requires smart financial management, and a crucial tool in that arsenal is a business line of credit. But how can you determine if it's the right option for your business and how much financing you can afford? That's where a business line of credit calculator comes in handy. By utilizing this powerful tool, you can estimate the cost of your loan and calculate your monthly payments. In this blog post, we will explore the benefits of using a business line of credit calculator and how it can help you make informed financial decisions for your business. So, let's dive in and discover how this tool can empower your financial journey.

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-loan-and-line-credit-v2-c8a910fad66a476db1a4c013517eefbb.jpg)

I. What is a Business Line of Credit?

Definition and Purpose

A business line of credit is a flexible financing option that provides a predetermined amount of capital to a business. Unlike a traditional business loan, a line of credit allows businesses to borrow funds as needed, up to the approved credit limit. The purpose of a business line of credit is to provide businesses with ongoing access to capital for various needs, such as managing cash flow fluctuations, purchasing inventory, covering unexpected expenses, or funding growth opportunities. It serves as a safety net, giving businesses the financial flexibility to handle day-to-day operations and seize opportunities without disrupting their operations or seeking additional financing.

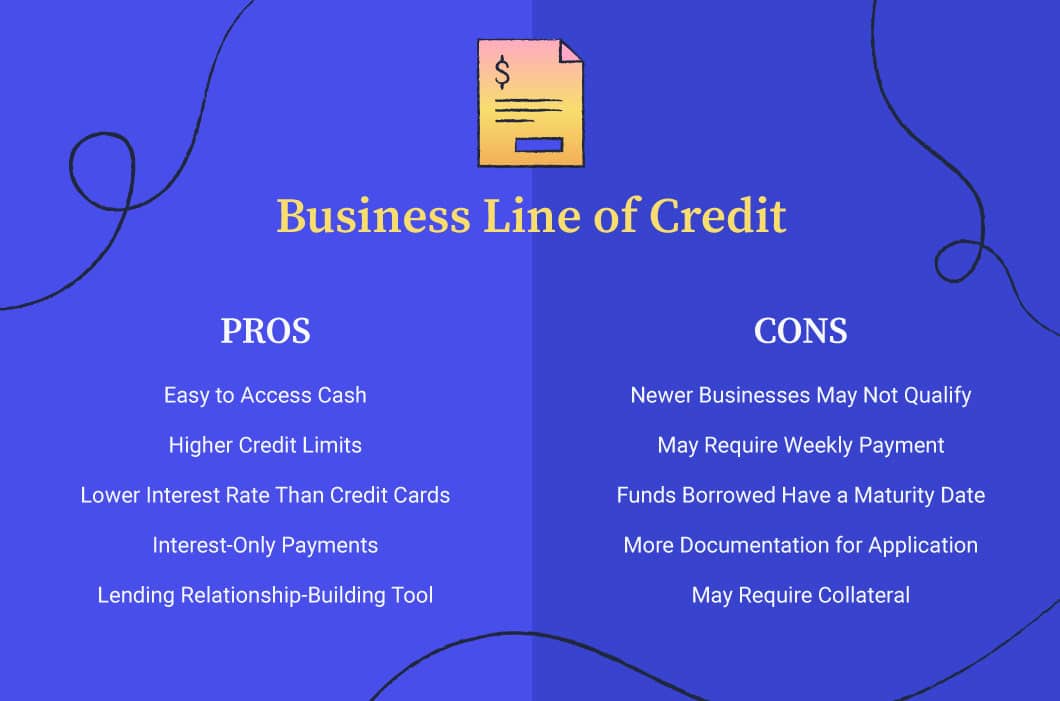

Key Benefits of a Business Line of Credit:

Flexibility: A line of credit offers businesses the flexibility to access capital whenever needed, without having to go through the application process for each withdrawal.

Ongoing Access to Capital: With a line of credit, businesses have the peace of mind knowing that they have a predetermined amount of capital available to them whenever they need it.

Cost-Effective: Borrowers only pay interest on the funds they withdraw, making it a more cost-effective solution compared to a traditional term loan where interest accrues on the entire loan amount.

Cash Flow Management: A line of credit can help businesses manage cash flow fluctuations, ensuring they have the necessary funds to cover expenses during lean periods or while waiting for payments from customers.

Opportunity for Growth: Having access to a line of credit can enable businesses to seize growth opportunities, invest in marketing, expand operations, or take advantage of discounted inventory or equipment.

Building Creditworthiness: Consistently using and repaying a line of credit can help businesses build a positive credit history, improving their creditworthiness for future financing needs.

Emergency Fund: A line of credit can also serve as an emergency fund, providing businesses with a financial buffer to address unexpected expenses or setbacks.

Overall, a business line of credit offers businesses the flexibility and financial cushion they need to navigate various challenges and capitalize on growth opportunities.

Benefits of a Business Line of Credit

A business line of credit offers numerous benefits for businesses of all sizes. Some key advantages include:

Flexibility: Unlike traditional term loans, a line of credit provides businesses with access to a revolving credit limit that can be used whenever necessary. This flexibility allows businesses to address short-term cash flow needs, take advantage of growth opportunities, and manage unexpected expenses.

Cost Savings: With a line of credit, businesses only pay interest on the amount of credit they actually use, rather than on the entire credit limit. This can lead to significant cost savings, particularly for businesses that have fluctuating financial needs or seasonal revenue cycles.

Quick Access to Funds: A line of credit offers businesses access to funds quickly and easily. Once the line of credit is approved, businesses can withdraw funds as needed, often within 24 hours. This eliminates the need to go through the lengthy approval process associated with traditional loans.

Building Credit History: By responsibly managing a line of credit, businesses can establish and build a solid credit history. A positive credit history can improve a business's chances of securing larger loans or better interest rates in the future.

Financial Stability: A line of credit provides a safety net for businesses, giving them peace of mind knowing that they have access to funds in case of emergencies or unexpected expenses. This can help businesses manage and navigate through challenging financial periods with confidence.

Here's a quick summary of the benefits of a business line of credit:

- Flexibility to use funds as needed

- Cost savings through interest only on the used amount

- Quick and easy access to funds

- Opportunity to build a strong credit history

- Financial stability and peace of mind during challenging times

II. How Does a Business Line of Credit Work?

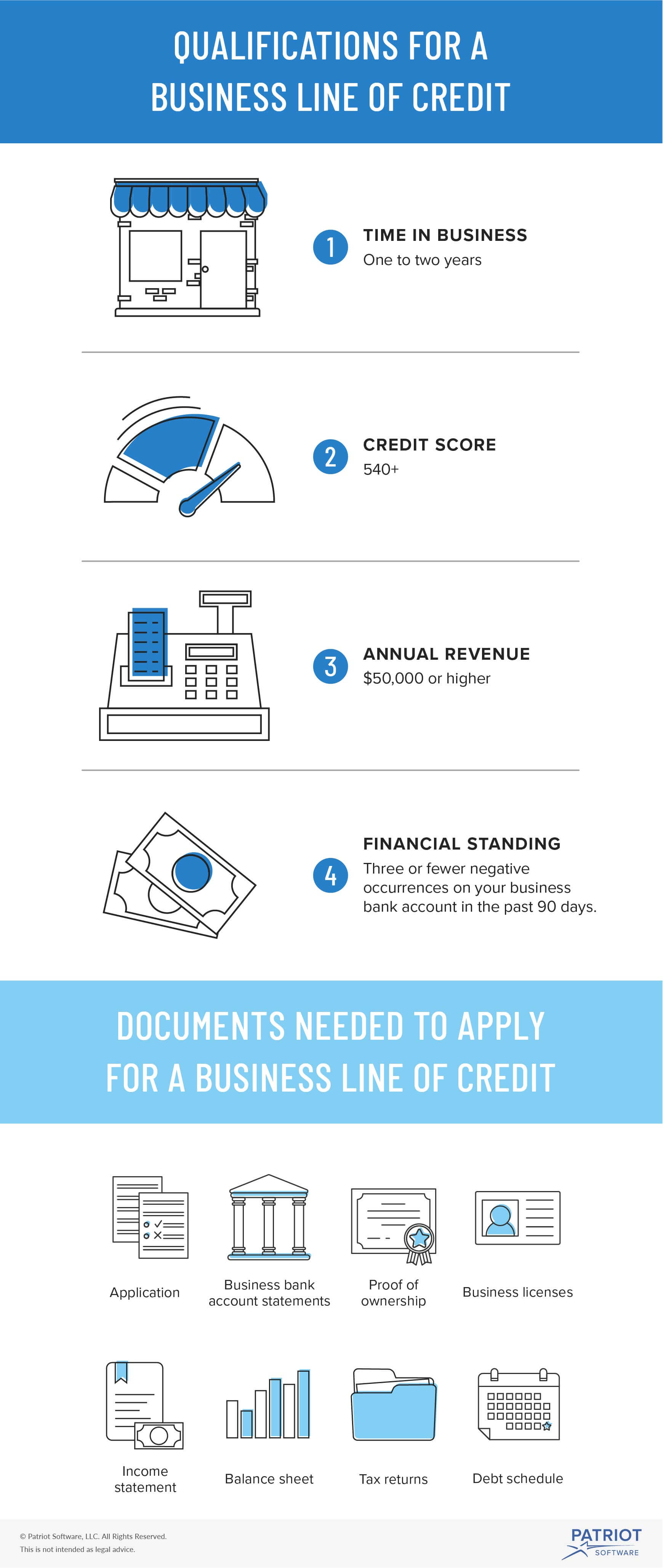

Qualifications and Eligibility

The qualifications and eligibility requirements for a business line of credit vary depending on the lender, but there are some common criteria that most lenders consider:

Credit Score: Lenders typically require a minimum credit score, which can range from 600 to 700 or higher depending on the lender's criteria.

Annual Revenue: Lenders will often require a minimum annual revenue for your business, such as $50,000 or more.

Time in Business: Many lenders prefer to work with businesses that have been operating for at least one to two years, although some lenders may consider startups with a shorter operating history.

Financial Statements: Lenders may require you to provide financial statements, such as profit and loss statements, balance sheets, and cash flow statements, to assess your business's financial health.

Collateral: Some lenders may require collateral, such as business assets, inventory, or accounts receivable, to secure the line of credit.

Business Debt: Lenders will evaluate your existing debt obligations, including loans and credit lines, to determine your ability to repay a new line of credit.

It's important to note that meeting these qualifications doesn't guarantee approval for a business line of credit. Lenders consider various factors in their decision-making process and may have additional eligibility criteria specific to their lending policies.

Application Process

The application process for a business line of credit is usually straightforward and can be completed online or through a traditional banking institution. Here are the general steps you can expect to take when applying for a business line of credit:

Research and Preparation: Prior to applying, gather all the necessary documents and information that will be required during the application process. This may include financial statements, tax returns, proof of business ownership, and other relevant documents.

Choose the Lender: Research and compare different lenders to find the one that offers the best terms and rates for your business needs. Consider factors such as interest rates, fees, repayment terms, and customer reviews.

Application Submission: Complete the online or physical application form provided by the lender. This form will typically require information about your business, such as its legal structure, annual revenue, industry, and credit history.

Documentation and Verification: Submit the required documents and information requested by the lender to verify your business's financial health and eligibility. This may include bank statements, business licenses, and financial statements.

Underwriting and Approval: The lender will evaluate your application and the provided documentation to determine your creditworthiness. They will assess factors such as your credit score, revenue history, and debt-to-income ratio. If approved, you will receive a credit limit and the terms of the line of credit.

Funding and Accessing Funds: Once approved, you will receive access to your business line of credit. This can be used for various business expenses, such as purchasing inventory, meeting payroll, or covering operational costs.

It's important to note that the application process may vary slightly depending on the lender and the specific requirements they have. It's always recommended to consult with the lender directly or review their website for detailed instructions on how to apply for a business line of credit.

III. Factors to Consider when Choosing a Business Line of Credit

Interest Rates and Fees

When considering a business line of credit, it's important to understand the associated interest rates and fees. These costs can vary depending on the lender and your business's creditworthiness. Interest rates for business lines of credit typically range from around 7% to 25%, but can be higher for riskier borrowers.

In addition to interest, lenders may also charge fees such as origination fees, maintenance fees, and annual fees. These charges can vary widely, so it's important to carefully review the terms and conditions of each lender to understand the full cost of borrowing.

Here's a brief summary of interest rates and fees for a business line of credit:

| Interest Rates | Fees |

|---|---|

| Range from 7% to 25% | Origination fees are typically 1-6% of the credit limit |

| Maintenance fees can range from $100 to a percentage of the credit limit | |

| Annual fees may range from $100 to a percentage of the credit limit | |

| Other fees could include transaction fees or withdrawal fees |

Keep in mind that these rates and fees are just estimates. It's essential to carefully review the terms and conditions provided by potential lenders to get an accurate understanding of the interest rates and fees that will apply to your specific business line of credit.

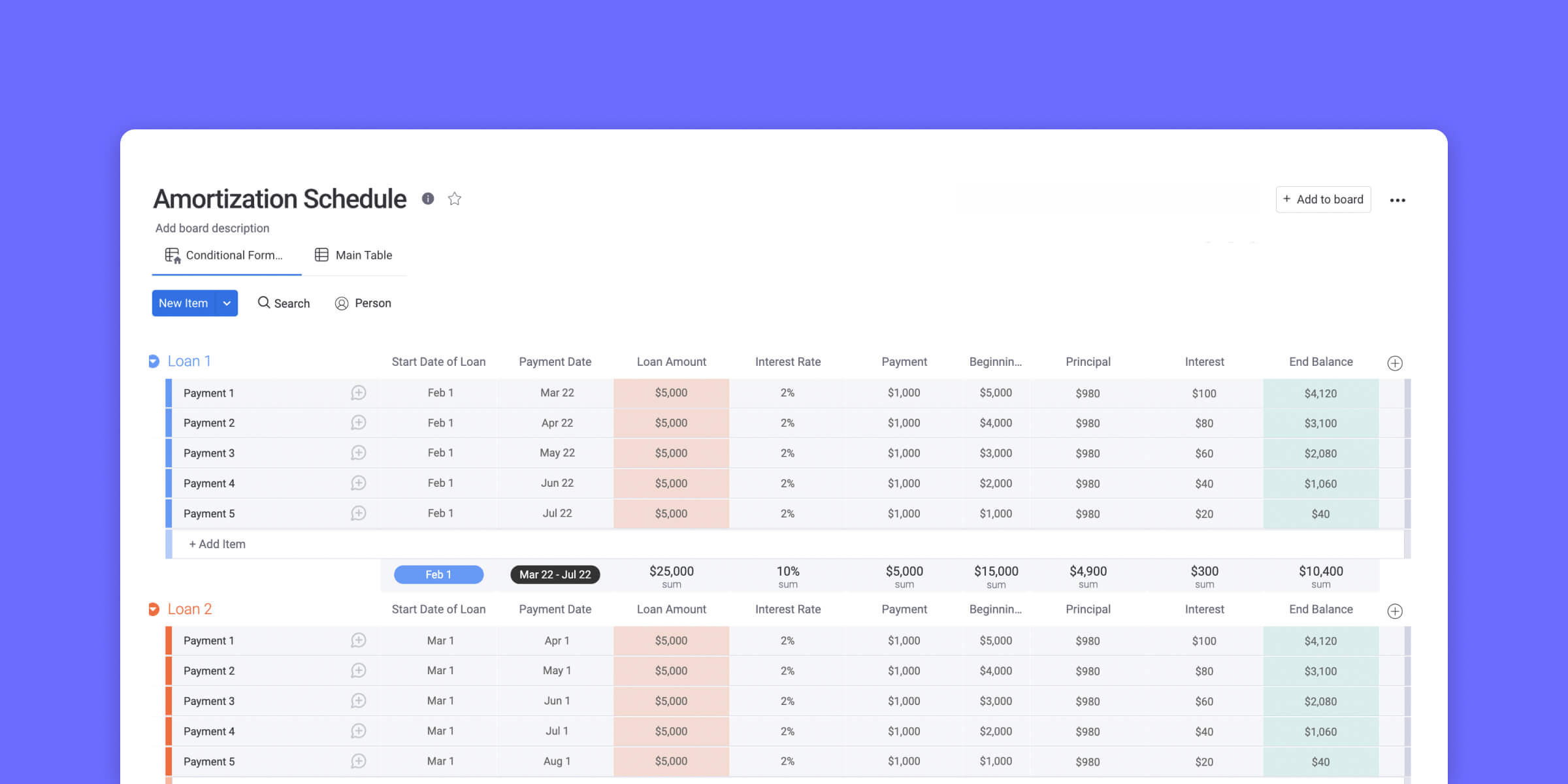

Repayment Terms and Flexibility

Repayment terms and flexibility are important considerations when utilizing a business line of credit. One of the benefits of a line of credit is the ability to access funds as needed and only pay interest on the amount borrowed. With flexible repayment terms, businesses have the option to make minimum monthly payments or pay off the balance in full without incurring any penalties. This provides businesses with the flexibility to manage their cash flow and repay the line of credit based on their specific financial circumstances. It also allows businesses to use the line of credit as a revolving source of funds for ongoing operational needs or unexpected expenses.

Here are some key points to consider about repayment terms and flexibility:

Minimum Monthly Payments: Businesses have the option to make minimum monthly payments, which typically include interest charges and a portion of the principal balance. This provides businesses with the flexibility to manage their cash flow and allocate funds towards other business expenses.

Paying Off the Balance: Businesses also have the option to pay off the balance in full at any time without incurring any prepayment penalties. This allows businesses to save on interest charges and have the flexibility to manage their debt obligations.

Revolving Source of Funds: With a line of credit, businesses have the ability to borrow funds, repay them, and borrow again as needed. This revolving nature of a line of credit provides businesses with ongoing access to funds for operational needs or unexpected expenses.

Interest Charges: Businesses will be charged interest on the amount borrowed from the line of credit. The interest rate and the frequency of interest charges may vary depending on the terms of the line of credit agreement.

Repayment Terms: The repayment terms of a business line of credit may vary depending on the lender. It's important for businesses to review and understand the repayment terms, including the repayment period and any associated fees or penalties.

By understanding the repayment terms and flexibility of a business line of credit, businesses can make informed decisions about their borrowing needs and effectively manage their cash flow.

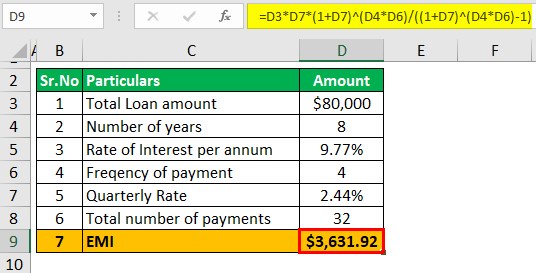

IV. Utilizing a Business Line of Credit Calculator

Understanding the Calculator

Understanding the business line of credit calculator is essential to effectively manage your financing options. This tool allows you to input specific information and calculate important details regarding your line of credit. The calculator takes into account factors such as loan amount, interest rate, and repayment terms to provide you with accurate figures.

Inputs

- Loan Amount: This is the maximum amount of money you can borrow from the line of credit.

- Interest Rate: The annual percentage rate (APR) at which the loan will accrue interest.

Outputs

- Monthly Payment: The amount you will need to repay each month, including both principal and interest.

- Total Interest Paid: The total amount of interest you will pay over the life of the loan.

Using the calculator allows you to experiment with different loan amounts and interest rates to determine the best financing options for your business. It provides you with a clear understanding of the financial implications of your chosen line of credit, helping you make informed decisions and manage your finances effectively.

Inputs and Outputs

When using a business line of credit calculator, it's important to understand the inputs and outputs involved. Inputs typically include the loan amount and the interest rate, which are used to calculate various outputs. The loan amount refers to the total amount of credit you plan to borrow, while the interest rate is the annual percentage rate charged by the lender. These inputs are crucial in determining the cost and terms of your line of credit.

The outputs produced by the calculator include details such as the monthly payment amount, the total cost of the credit, and the repayment term. The monthly payment amount is the sum you'll need to pay each month to repay the credit within the specified time period. The total cost of the credit represents the overall amount you'll pay, including interest and any additional fees. Lastly, the repayment term refers to the duration of time you have to repay the credit in full.

By using a business line of credit calculator, you can gain a better understanding of the financial implications of your borrowing decisions. It helps you assess the affordability and feasibility of a line of credit, allowing you to make informed decisions about your business's financial needs.

V. Key Metrics and Variables in the Calculator

Loan Amount

The loan amount is a crucial factor to consider when using a business line of credit calculator. It refers to the total amount of money that a business is looking to borrow from the lender. The loan amount can vary depending on the specific needs of the business, such as financing for inventory, equipment purchases, or working capital. It is important to accurately determine the loan amount in order to calculate the potential interest and repayment terms accurately. Businesses should carefully assess their financial needs and budget constraints before deciding on the loan amount to ensure it aligns with their goals and ability to repay.

Comments

Post a Comment