Starting a new business can be exciting, but it can also come with its fair share of financial challenges. One of the key aspects to consider is how to manage your cash flow effectively. This is where a business line of credit can be incredibly useful. A business line of credit allows you to borrow from a set amount of money, providing you with the flexibility to cover short-term expenses and manage cash flow gaps. In this blog post, we will explore the best options for a startup business line of credit and provide information on how to qualify for this type of financing. So if you're a new business owner looking for ways to access funding and effectively manage your finances, keep reading to learn more.

I. Introduction to Business Line of Credit

What is a Business Line of Credit?

A business line of credit is a flexible financing option that provides a business with access to a predetermined amount of money. Similar to a credit card, a line of credit allows a business to borrow funds as needed and only pay interest on the amount borrowed. It provides a revolving source of capital that can be used for various business expenses, such as inventory purchase, payroll, or marketing campaigns.

Here's a summary of the key features of a business line of credit:

- Flexibility: A line of credit allows businesses to borrow funds as needed, giving them the flexibility to manage cash flow and cover unexpected expenses.

- Revolving: Once a portion of the line of credit is repaid, the funds become available again, allowing the business to borrow repeatedly as long as they stay within the credit limit.

- Interest-only payments: Businesses only pay interest on the amount borrowed, not the entire credit limit, which can help minimize monthly expenses.

- Variable interest rates: The interest rate on a line of credit can fluctuate based on market conditions and the borrower's creditworthiness.

- Access to funds: With a line of credit, businesses can typically access funds through checks, online transfers, or a designated credit card linked to the account.

Having a line of credit can provide several benefits to new businesses, including:

- Cash flow management: A line of credit can help bridge the gap between receivables and payables, ensuring that a business has enough funds to cover its expenses.

- Opportunity to seize business opportunities: Having access to a line of credit can enable businesses to take advantage of growth opportunities, such as purchasing inventory at a discounted price or investing in marketing campaigns.

- Build business credit: Responsible use of a line of credit can help establish and improve a business's credit history, making it easier to qualify for larger loans in the future.

- Emergency funds: A line of credit can serve as a safety net for unforeseen circumstances, allowing businesses to cover unexpected expenses or manage financial emergencies.

Please note that specific terms and conditions can vary depending on the lender and the borrower's creditworthiness. It is recommended to carefully review the terms and consult with a financial advisor before applying for a business line of credit.

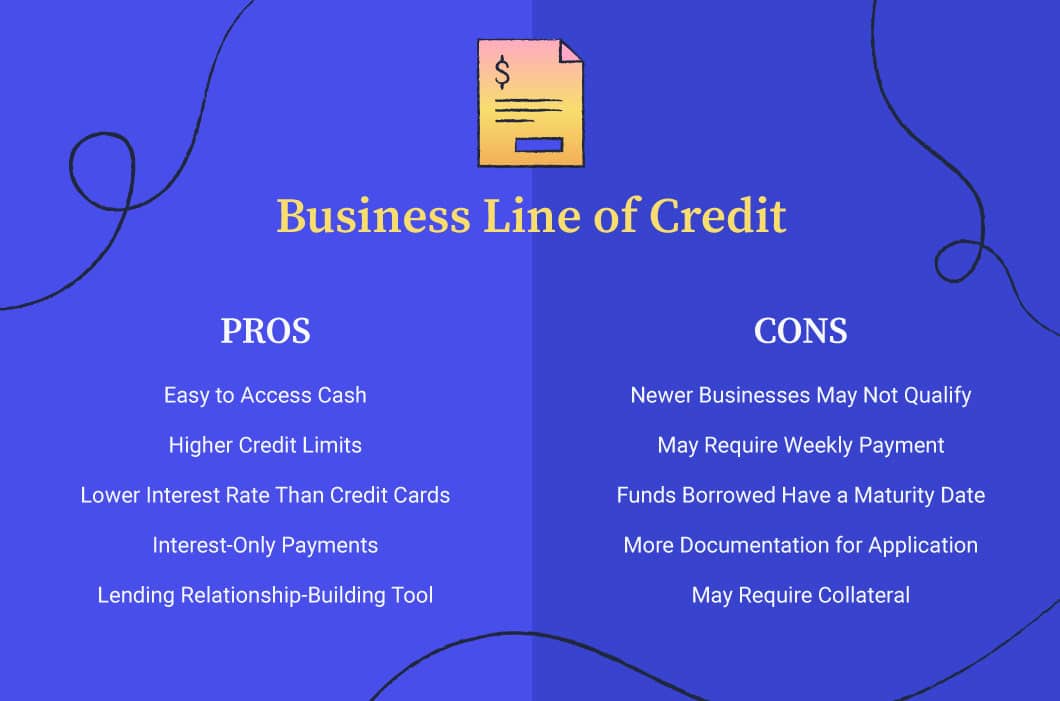

Benefits of having a Business Line of Credit

A business line of credit offers numerous benefits to new businesses, including:

Flexibility: A line of credit provides access to funds whenever they are needed, giving businesses the ability to manage cash flow fluctuations and cover unexpected expenses.

Working Capital: By having a business line of credit, companies can maintain adequate working capital to seize growth opportunities, invest in new projects, or fund marketing initiatives.

Easier Access to Funds: Compared to traditional loans, which require a lengthy application process, a business line of credit offers easier and faster access to funds, ensuring that businesses can respond promptly to financial needs.

Cost-Effective: Businesses only pay interest on the amount of credit they use, making it a cost-effective financing solution. Additionally, by establishing a line of credit when the business is in good financial health, companies can often secure lower interest rates.

Building Credit History: Proper utilization of a business line of credit can help improve a company's credit score and financial profile, making it easier to access larger amounts of credit and better loan terms in the future.

Here's a summary of the benefits of a business line of credit:

| Benefit | Description |

|---|---|

| Flexibility | Provides businesses with access to funds when they need them, ensuring they have the necessary cash flow. |

| Working Capital | Enables businesses to maintain working capital for growth, investments, and marketing initiatives. |

| Easy Access | Offers a streamlined and faster application process compared to traditional loans. |

| Cost-Effectiveness | Businesses pay interest only on the amount used, resulting in cost-effective financing. |

| Credit Building | Responsible use can help businesses build credit history, improving access to larger credit amounts in the future. |

II. How to Qualify for a Business Line of Credit

Factors that Lenders Consider

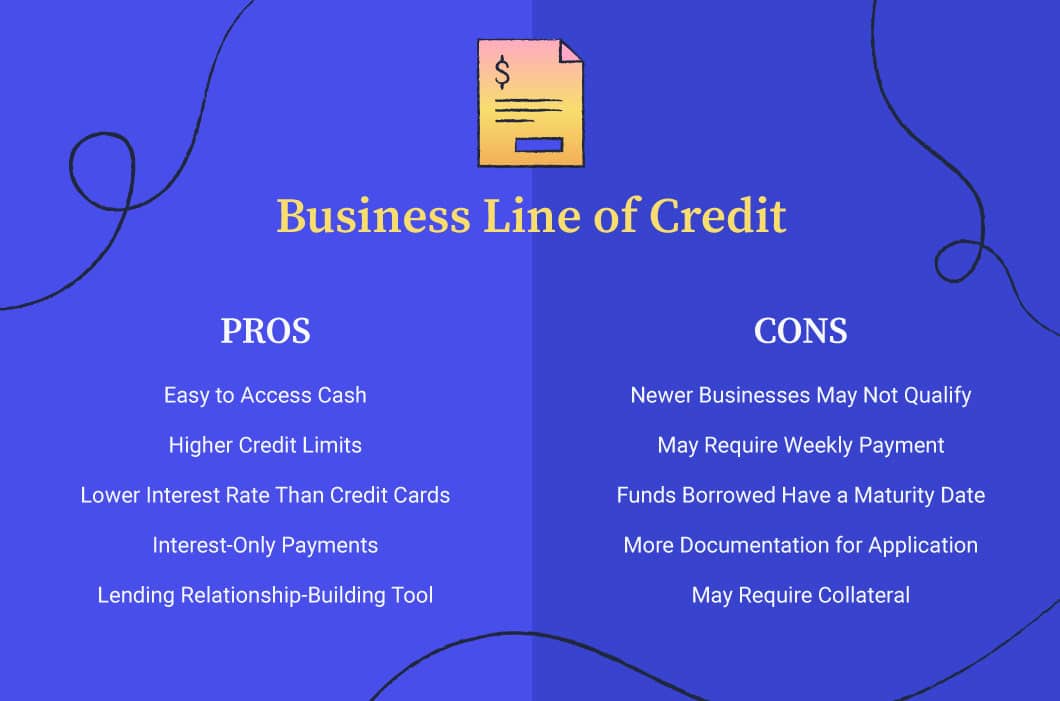

When applying for a business line of credit, lenders consider several factors before approving your application. These factors typically include:

Credit Score: Lenders assess your personal and business credit scores to determine your creditworthiness. A higher credit score increases your chances of securing a line of credit.

Financial History: Lenders review your business's financial history, including its revenue, cash flow, and profitability. They want to ensure that your business has a stable and reliable financial track record.

Time in Business: Lenders prefer to work with businesses that have been established for a certain period, typically at least one to two years. Startups or businesses with a shorter operating history may face more challenges in securing a line of credit.

Collateral: Some lenders may require collateral to secure the line of credit. This could be in the form of business assets, inventory, or accounts receivable. Providing collateral reduces the lender's risk and can increase your chances of approval.

Purpose of the Line of Credit: Lenders want to know how you plan to use the funds. Having a clear and well-defined purpose, such as financing inventory or expanding operations, can strengthen your application.

Debt-to-Income Ratio: Lenders also evaluate your business's debt-to-income ratio, which measures your ability to manage debt. A healthy ratio demonstrates your financial stability and ability to repay the line of credit.

Industry and Market Conditions: Lenders may consider the industry and market conditions your business operates in. They may have specific criteria or preferences for certain industries or may be more cautious if the industry is facing challenges.

Remember that each lender may have specific requirements and considerations, so it's essential to research and understand their criteria before applying for a business line of credit.

Credit Score and Financial History Requirements

When applying for a business line of credit, lenders typically consider your credit score and financial history. A strong credit score and a positive track record of managing your finances can greatly increase your chances of approval. Lenders want to see that you have a good credit history, including a history of making timely payments and keeping your credit utilization low. They may also review your personal and business tax returns, bank statements, and financial statements to assess your financial stability and ability to repay the loan.

Here are some key credit score and financial history requirements that lenders may have:

Credit Score: Lenders often have a minimum credit score requirement, which can vary depending on the lender and the type of line of credit you're applying for. Generally, a credit score of at least 600 is considered to be a good starting point, but some lenders may require higher scores.

Time in Business: Lenders may prefer businesses that have been operating for a certain period of time, such as at least six months or a year. This helps demonstrate stability and reliability.

Revenue and Profitability: Lenders may also consider your business's revenue and profitability. They want to see that your business has consistent income and is capable of generating enough cash flow to repay the line of credit.

Debt-to-Income Ratio: Lenders may review your debt-to-income ratio, which compares your monthly debt payments to your monthly income. A lower ratio indicates you have fewer financial obligations and are better positioned to manage additional debt.

Late Payments and Bankruptcies: Lenders will likely check for any late payments or bankruptcies on your credit report. While having some small delinquencies in the past might not disqualify you, a history of major financial issues could make it more challenging to secure a business line of credit.

Remember that each lender has its own specific requirements and criteria, so it's important to research and compare different options to find the one that best suits your business needs and financial situation.

III. Types of Business Line of Credit

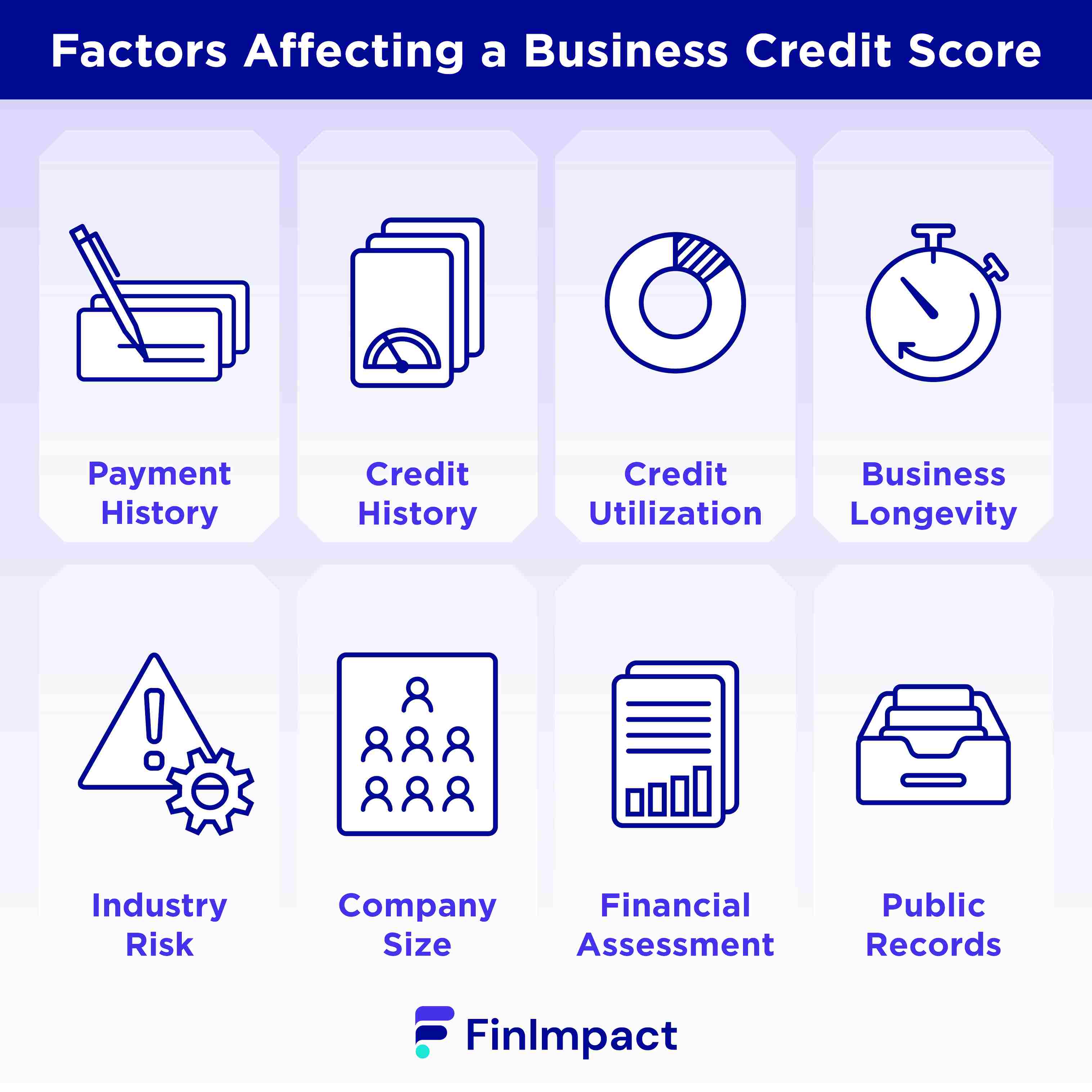

Secured vs Unsecured Business Line of Credit

When considering a business line of credit, it's important to understand the difference between secured and unsecured options.

A secured business line of credit requires collateral, such as real estate, inventory, or equipment, to secure the loan. This collateral serves as a guarantee for the lender, reducing the risk of default. Secured lines of credit often have higher borrowing limits and lower interest rates compared to unsecured options.

On the other hand, an unsecured business line of credit does not require collateral. Instead, the lender assesses the creditworthiness and financial stability of the borrower. Unsecured lines of credit are typically more difficult to qualify for and often come with lower borrowing limits and higher interest rates.

Here's a quick comparison of secured and unsecured business lines of credit:

| Secured Business Line of Credit | Unsecured Business Line of Credit | |

|---|---|---|

| Collateral Requirement | Requires collateral as a guarantee for the loan | No collateral required |

| Risk Assessment | Lower risk for lenders due to collateral | Higher risk for lenders, based on creditworthiness |

| Borrowing Limits | Higher borrowing limits | Lower borrowing limits |

| Interest Rates | Generally lower interest rates | Generally higher interest rates |

| Eligibility Criteria | Assets to be used as collateral | Strong credit history and financial stability |

| Application Process | Longer application process, due to collateral evaluation | Smoother, streamlined application process |

By understanding the differences between secured and unsecured options, you can choose the type of business line of credit that best suits your needs and financial situation.

Revolving vs Non-Revolving Line of Credit

When considering a business line of credit, it's important to understand the difference between revolving and non-revolving lines of credit.

A revolving line of credit provides flexibility as it allows you to borrow funds, repay them, and borrow again up to a predetermined credit limit. This means that you can access funds whenever you need them, making it ideal for managing cash flow fluctuations and unexpected expenses.

On the other hand, a non-revolving line of credit provides a one-time lump sum that you can use for a specific purpose. Once you repay the borrowed amount, the credit line is closed, and you will need to apply for a new line of credit if you need additional funds.

Here's a table comparing the key differences between revolving and non-revolving lines of credit:

| Revolving Line of Credit | Non-Revolving Line of Credit | |

|---|---|---|

| Access to funds | Borrow, repay, and borrow again | One-time lump sum |

| Flexibility | Can access funds as needed | Limited flexibility |

| Repayment terms | Minimum monthly payments | Fixed repayment schedule |

| Interest rates | Variable interest rates | Fixed interest rates |

| Purpose | General working capital, cash flow management | Specific projects or purchases |

Understanding the differences between revolving and non-revolving lines of credit will help you determine which option best suits your business needs and financial goals.

IV. Top Lenders for Business Line of Credit

Bank of America

When it comes to finding a business line of credit, Bank of America is a popular choice for many new businesses. With its extensive network and range of financial products, Bank of America offers various options for businesses looking for a line of credit. Here are some key features and benefits of Bank of America's business line of credit:

Flexible Credit Limit: Bank of America offers a flexible credit limit, allowing businesses to access funds based on their specific needs and financial situation.

Competitive Interest Rates: Bank of America provides competitive interest rates, helping businesses to manage their expenses while keeping borrowing costs low.

Convenient Access to Funds: With Bank of America, businesses can access their line of credit funds easily and conveniently through online banking, mobile banking, and other digital platforms.

Dedicated Customer Support: Bank of America offers dedicated customer support to assist businesses throughout the application and borrowing process.

Business Banking Solutions: In addition to a business line of credit, Bank of America provides a wide range of business banking solutions, including cash management, merchant services, and business credit cards.

While Bank of America is a reputable option, it's always beneficial to explore multiple lenders and compare their offerings, interest rates, and terms to ensure you find the best fit for your new business's needs.

Wells Fargo

Wells Fargo is a well-established and reputable bank that offers a variety of financial products and services, including business lines of credit. Here are some key points to consider about Wells Fargo and their business line of credit options:

Reputation and Experience: Wells Fargo is one of the largest banks in the United States and has a long history of serving businesses of all sizes. They have expertise in providing financial solutions to businesses and can offer valuable guidance and support.

Flexible Credit Limits: Wells Fargo offers flexible credit limits for their business lines of credit, allowing businesses to access the funds they need to manage their operations, cover unexpected expenses, or invest in growth opportunities.

Competitive Interest Rates: Wells Fargo aims to provide competitive interest rates for their business lines of credit, helping businesses minimize their borrowing costs and maximize their profitability.

Convenient Access to Funds: With Wells Fargo's business line of credit, businesses can access funds conveniently whenever they need them. This flexibility allows businesses to react quickly to changing market conditions or take advantage of time-sensitive opportunities.

Additional Benefits and Services: In addition to business lines of credit, Wells Fargo offers a range of complementary services and benefits for business customers, including cash management solutions, merchant services, and business savings accounts.

It is important for business owners to research and compare different lenders and their offerings to find the best business line of credit option that fits their specific needs and requirements.

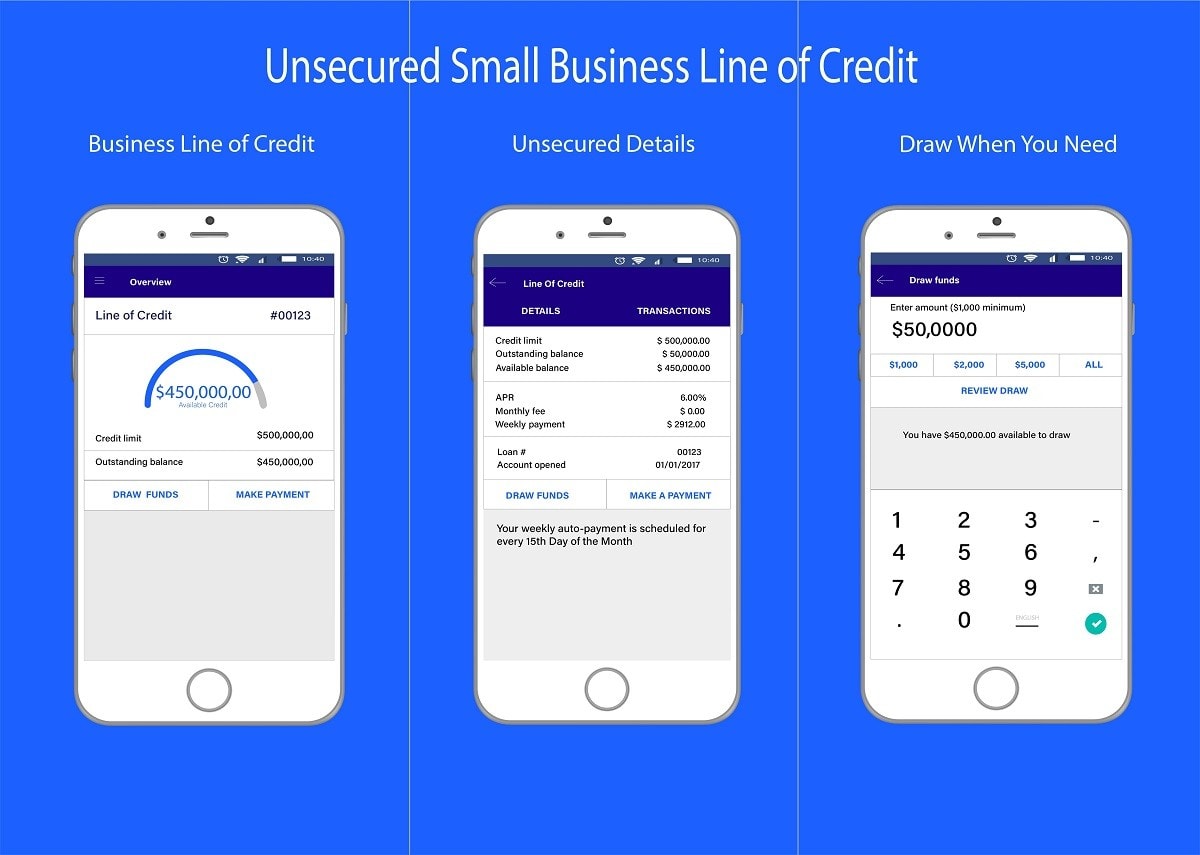

Chase Business Banking

Chase Business Banking is a popular option for entrepreneurs looking for a business line of credit. They offer flexible borrowing options and competitive interest rates. Additionally, Chase provides a variety of business banking services, including checking accounts, credit cards, and merchant services. Their online platform makes it easy to manage your business finances and access your line of credit when needed. With a solid reputation and nationwide presence, Chase Business Banking is a reliable choice for new businesses in need of financing.

V. Alternative Sources for Business Line of Credit

Online Lenders

Online lenders offer a convenient and accessible option for obtaining a business line of credit. These lenders typically have a streamlined application process that can be completed online, allowing business owners to quickly access the funds they need. Some popular online lenders for business lines of credit include:

BlueVine: BlueVine offers a revolving line of credit with limits up to $250,000. They have a simple online application process and provide fast funding.

Kabbage: Kabbage provides a flexible line of credit with limits up to $250,000. They use automated, real-time data to evaluate applications, making their approval process quick and efficient.

Fundbox: Fundbox offers a line of credit up to $150,000 with a focus on helping small businesses bridge cash flow gaps. They have a simple online application and provide funding within one business day.

OnDeck: OnDeck offers a range of financing options, including lines of credit up to $100,000. Their online application process is straightforward, and they provide quick funding for approved businesses.

When considering online lenders, it's important to compare factors such as interest rates, repayment terms, and any fees associated with the line of credit. Additionally, it's essential to review customer reviews and ratings to ensure the lender has a solid reputation and provides excellent customer service.

Comments

Post a Comment