When it comes to financing your business, having access to a line of credit can be a real game-changer. But with so many lenders and varying rates, how do you know which one is right for you? In this blog post, we'll explore the best business lines of credit for 2023 based on factual data, including credit line amounts, terms, and eligibility requirements. Whether you're a small business owner or an established company, finding the right line of credit can give you the financial flexibility you need to grow and succeed. So let's dive in and discover the top options for business line of credit rates in 2023.

I. Introduction to Business Line of Credit

What is a Business Line of Credit?

A business line of credit is a flexible financing option that allows businesses to access funds up to a pre-set limit. Unlike a traditional loan, where a borrower receives a lump sum, a line of credit provides ongoing access to funds that can be used as needed. It works similar to a credit card, where you can borrow and repay, and interest is only charged on the amount borrowed. This revolving form of credit offers convenience and is often used to finance short-term working capital needs, manage cash flow fluctuations, or seize unexpected business opportunities.

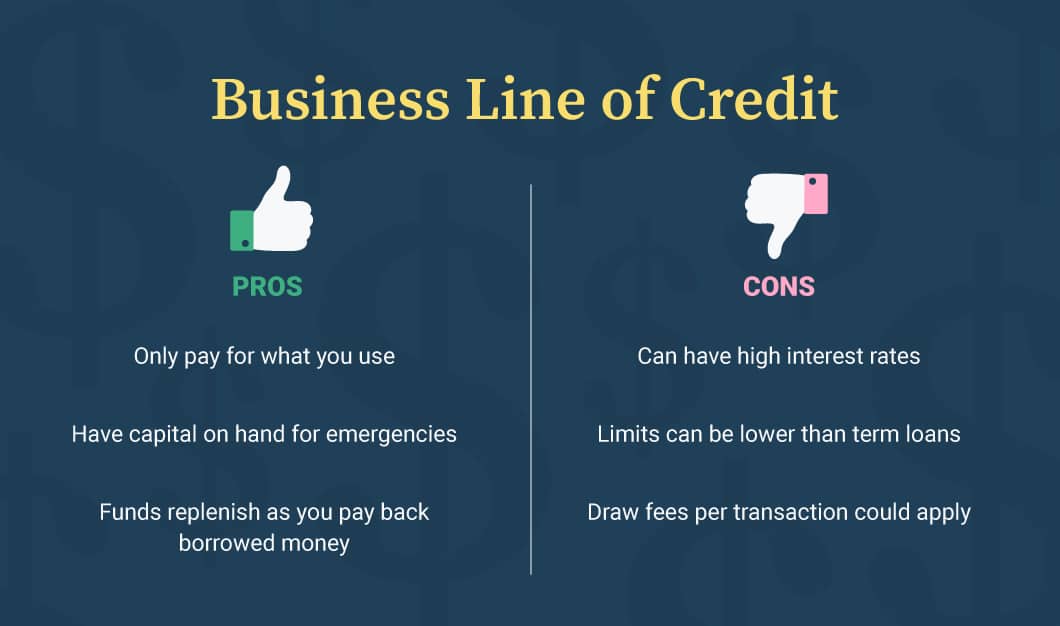

Here's a quick summary of the benefits of using a business line of credit:

- Flexibility: Access funds as needed, up to your approved credit limit.

- Cost-effective: Pay interest only on the amount you borrow, not on the entire credit limit.

- Working capital management: Use the line of credit to cover day-to-day expenses, inventory purchases, or unexpected costs.

- Cash flow management: Bridge the gap between accounts receivable and accounts payable to ensure a steady cash flow.

- Business growth: Invest in growth opportunities or finance expansion projects.

- Emergency funds: Have a safety net for unexpected emergencies or sudden business expenses.

Using a business line of credit can provide the financial flexibility and peace of mind that every business needs, allowing you to navigate cash flow challenges and seize growth opportunities when they arise. It's important to compare rates and terms from different lenders to find the best option that suits your business

Benefits of Using a Business Line of Credit

Using a business line of credit offers several benefits for entrepreneurs and business owners. Here are some key advantages:

Flexibility: With a business line of credit, you have access to funds that can be used for various purposes, such as managing cash flow, purchasing inventory, or covering unexpected expenses.

Cost-effective: Compared to traditional loans, where you pay interest on the entire loan amount, a business line of credit allows you to pay interest only on the funds you actually use. This can result in cost savings.

Revolving credit: A business line of credit is a revolving form of financing, meaning that as you repay the borrowed amount, the credit becomes available for use again. This makes it a convenient and flexible option for ongoing funding needs.

Quick access to funds: Once approved, you can access funds from your business line of credit quickly and easily, providing you with the working capital you need in a timely manner.

Improved cash flow management: A business line of credit helps you manage cash flow fluctuations by providing a safety net when revenues are low or expenses are high. This ensures that you can meet financial obligations and seize growth opportunities.

Overall, a business line of credit offers the flexibility, convenience, and cost-effectiveness that can support your business's financial needs and help drive growth.

II. Factors Affecting Business Line of Credit Rates

Credit Score and History

When applying for a business line of credit, lenders will consider your credit score and history to assess your creditworthiness. A higher credit score demonstrates a strong history of managing credit responsibly, which can increase your chances of obtaining favorable rates. Lenders will also look at any instances of late payments, bankruptcies, or defaults on your credit report. Keeping a good credit score and maintaining a positive credit history is crucial in securing competitive rates from lenders.

Business Financials and Performance

When applying for a business line of credit, lenders will typically assess your business financials and performance. They will review factors such as your revenue, cash flow, profit margins, and debt-to-income ratio. Lenders want to ensure that your business is financially healthy and capable of repaying the credit. They may also consider your business credit history, industry trends, and the overall economic climate. Providing detailed financial statements, including balance sheets, income statements, and cash flow statements, will help lenders evaluate your business's financial viability and determine the interest rates and terms of your line of credit.

Here's a checklist of key factors that lenders may consider when assessing your business financials and performance:

- Revenue and sales growth trends

- Profitability and profit margins

- Cash flow and liquidity

- Outstanding debts and liabilities

- Debt-to-income ratio

- Business credit history and payment track record

- Customer and supplier relationships

- Industry and market trends

- Economic conditions and outlook

Remember, maintaining strong financials and demonstrating consistent business performance will increase your chances of securing a business line of credit at favorable rates and terms. It's essential to regularly monitor your financial health, be proactive in managing your cash flow, and provide accurate and up-to-date financial information to lenders.

Lender's Risk Assessment

Lender's risk assessment plays a crucial role in determining the interest rates for a business line of credit. Lenders assess a company's creditworthiness by looking at factors such as the borrower's credit history, financials, industry performance, and potential risks. Based on this assessment, the lender determines the interest rate that reflects the level of risk they are taking by extending the line of credit to the business.

Factors that lenders typically consider during the risk assessment process include:

- Credit score of the business and its owners

- Previous loan repayment history

- Business financial statements, including cash flow, revenue, and profitability

- Industry trends and the stability of the business's market

- Potential risks associated with the business, such as competition and regulatory factors

By evaluating these factors, lenders can gauge the level of risk associated with lending to a particular business and determine an appropriate interest rate for the line of credit.

It's important to note that different lenders may have varying risk assessment criteria and methodologies, which can influence the interest rates they offer. It's advisable for business owners to compare rates from different lenders to find the most competitive deal that suits their financial needs and risk profile.

III. Average Business Line of Credit Rates in 2023

Comparison of Rates from Different Lenders

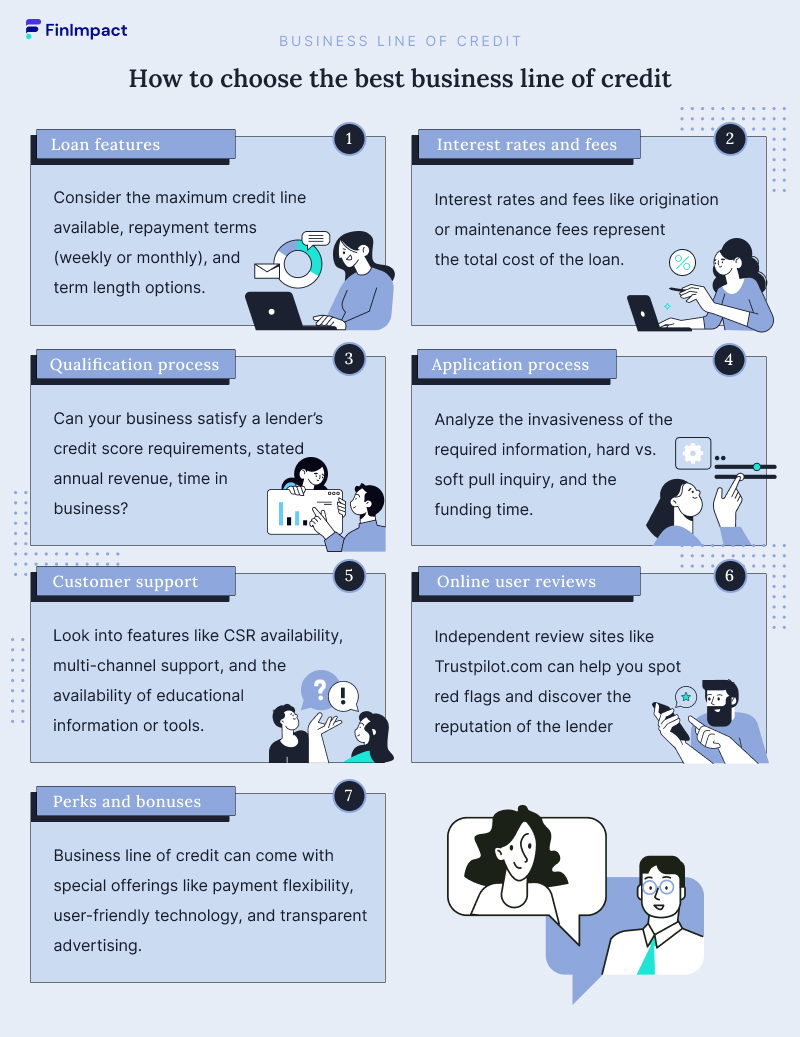

When comparing rates from different lenders for a business line of credit, it's important to consider factors such as interest rates, fees, and repayment terms. Create a table to compare these key factors for each lender. Look for competitive rates and favorable terms that align with your business's financial needs. Don't forget to also evaluate customer reviews and the lender's reputation for quality service. Ultimately, choose a lender that offers the most advantageous rates and terms for your business.

Trends in Business Line of Credit Rates

When looking at the trends in business line of credit rates for 2023, it is important to consider several factors that can impact the rates offered by different lenders. These factors include the current economic climate, the lender's risk assessment of the borrower, and the borrower's creditworthiness. Additionally, market competition among lenders can also influence rates. It's always advisable to compare rates from different lenders to

IV. Top Lenders Offering Competitive Rates

Lender A

When considering a business line of credit, it's important to compare rates and features from different lenders. Lender A offers competitive rates and attractive features for businesses. Here's a summary of their rates and features:

- Interest Rate: Lender A offers a variable interest rate starting at X%, allowing businesses to take advantage of current market conditions.

- Credit Limit: Businesses can access a credit limit ranging from $X to $X, providing flexibility for varying financial needs.

- Repayment Terms: Lender A offers flexible repayment terms, with options for monthly or quarterly payments.

- Application Process: The application process with Lender A is streamlined and efficient, ensuring a quick approval and funding process.

By comparing rates and features from different lenders like Lender A, businesses can make an informed decision that aligns with their financial goals and objectives.

Rates and Features

When considering business line of credit rates in 2023, it's essential to compare rates and features offered by different lenders. Here's a summary of rates and features for Lender A and Lender B:

Lender A:

- Interest Rate: 7.5%

- Credit Limit: Up to $250,000

- Repayment Terms: Flexible

- Funding Speed: Quick approval and access to funds

- Additional Fees: None

- Customer Service: 24/7 support available

Lender B:

- Interest Rate: 9%

- Credit Limit: Up to $500,000

- Repayment Terms: Fixed monthly payments

- Funding Speed: Fast approval process

- Additional Fees: Origination fee of 2%

- Customer Service: Dedicated account manager

Comparing rates and features will help determine the best fit for your business's financial needs and goals. It's also important to consider factors such as customer service, repayment terms, and additional fees when choosing a lender.

Comments

Post a Comment