I. Introduction

Starting a new business can be an exciting and challenging endeavor. One of the key challenges for new businesses is managing cash flow and accessing capital to support growth and operations. This is where a business line of credit can play a vital role.

The Importance of Business Line of Credit for New Businesses

A business line of credit is a flexible financing option that provides a predetermined amount of capital which a business can draw from as needed. It serves as a safety net, allowing businesses to cover unexpected expenses, take advantage of growth opportunities, and manage cash flow gaps. For new businesses that may not have a history of revenue or established credit, a business line of credit can provide the necessary financial support to bridge the gap between startup costs and generating consistent revenue.

Understanding Business Line of Credit for Startups

A business line of credit for startups works similarly to a personal line of credit. It provides access to a set amount of funds that can be borrowed and repaid as needed. However, it is important to note that obtaining a line of credit for a new business with no revenue can be challenging. Lenders typically consider various factors when evaluating a startup's eligibility for a line of credit, such as the owner's personal credit score, business plan, industry trends, and collateral.

Despite the challenges, securing a business line of credit for a new business can provide numerous benefits, including:

Flexibility and Control: A line of credit allows business owners to access funds on an as-needed basis, providing flexibility and control over cash flow management.

Financial Stability: Having access to a line of credit can provide peace of mind and financial stability, knowing that there is a safety net in case of unexpected expenses or fluctuations in revenue.

Establishing Credit History: Successfully managing a business line of credit can help new businesses establish a positive credit history, making it easier to access additional financing in the future.

Growth Opportunities: With a line of credit, new businesses can seize growth opportunities, such as investing in marketing, purchasing inventory, or hiring additional staff, that can propel their business forward.

Improving Cash Flow: A line of credit can help bridge cash flow gaps, ensuring that the business can cover its expenses and meet its financial obligations without interruption.

In conclusion, while obtaining a business line of credit for a new business with no revenue can be challenging, it is not impossible. By developing a strong business plan, demonstrating industry knowledge, and maintaining a solid personal credit score, new businesses can increase their chances of securing a line of credit that can provide the necessary financial support during the early stages of their business.

II. Benefits of Business Line of Credit for New Businesses

Starting a new business can be challenging, especially when it comes to managing cash flow and accessing funds for growth. That's where a business line of credit can be a valuable tool for new businesses with no revenue. Here are some benefits of obtaining a business line of credit:

Access to Working Capital

A business line of credit provides access to a predetermined amount of funds that can be used to cover day-to-day expenses, inventory purchases, payroll, and other operational costs. This flexibility allows new businesses to meet their financial obligations and seize growth opportunities.

Flexibility and Convenience

Unlike traditional business loans, a line of credit offers flexibility in terms of when and how funds are used. Business owners can draw on the line of credit as needed, and they only pay interest on the amount they borrow. This provides convenience and cost-effectiveness, especially for businesses with fluctuating cash flow.

Building Business Credit

By responsibly using a business line of credit, new businesses have an opportunity to establish and build their credit profile. This can be beneficial when seeking additional financing options in the future, as lenders often consider a company's credit history when evaluating loan applications.

Overall, a business line of credit can provide new businesses with the financial flexibility and stability they need to navigate the challenges of the early stages. It's important to carefully consider the terms and conditions of the line of credit and choose a lender that best suits the specific needs of the business.

III. Providers of Business Line of Credit for New Businesses

When it comes to securing a business line of credit for a new business with no revenue, there are several options available. Here are some common providers of business lines of credit for new businesses:

Traditional Banks

Traditional banks have long been a source of financing for businesses, offering business loans and lines of credit. They typically require a solid credit history and collateral to secure the credit line.

Online Lenders

Online lenders have emerged as a convenient alternative to traditional banks. They often have less stringent requirements and faster application processes, making them a popular choice for new businesses without revenue.

Alternative Financing Options

In addition to traditional banks and online lenders, there are also alternative financing options available for new businesses. These may include crowdfunding platforms, angel investors, or government grants and loans.

It's important for new businesses to carefully consider their financing options and choose the best provider that suits their needs and goals. Conducting thorough research and comparing offers can help ensure a successful application for a business line of credit.

IV. Requirements and Eligibility for Business Line of Credit

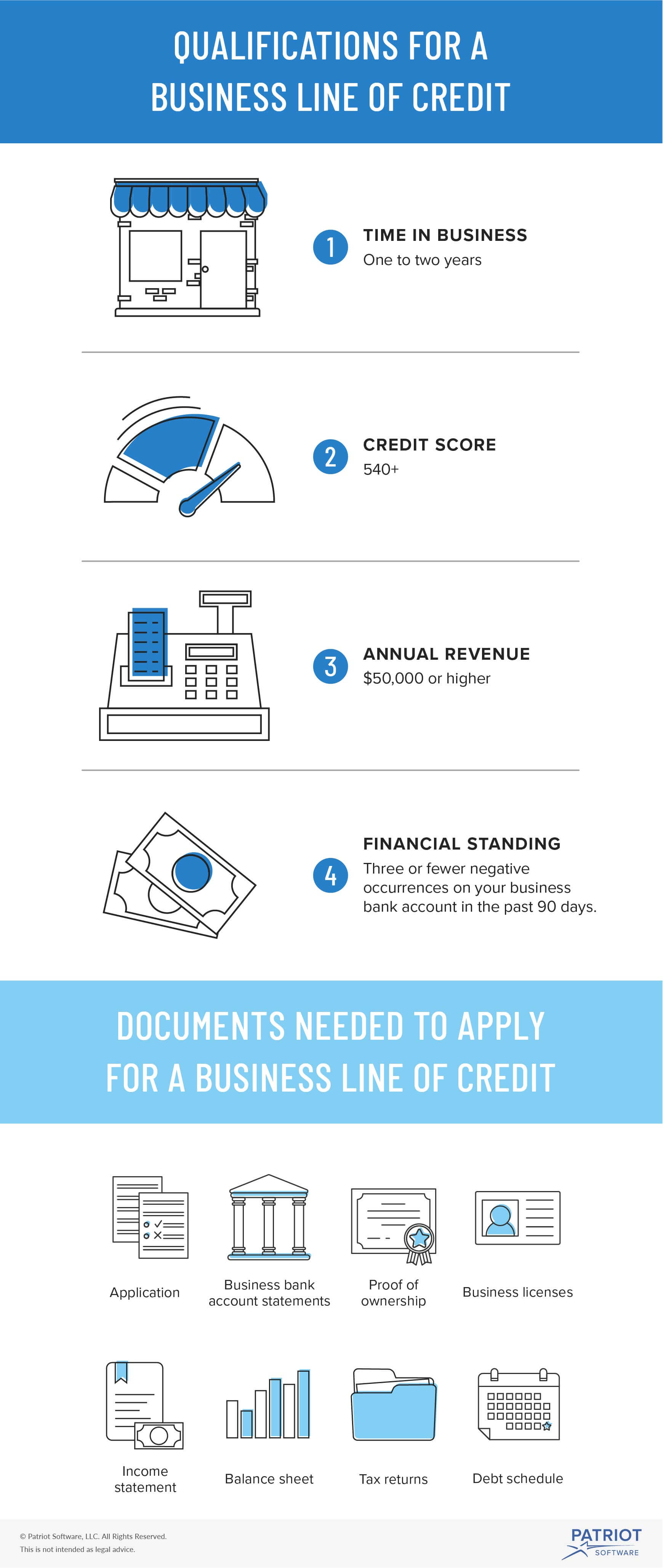

When it comes to obtaining a business line of credit for a new business with no revenue, there are certain requirements and eligibility criteria that lenders typically consider. While each lender may have specific criteria, here are some common factors to keep in mind:

Credit Score and History

Credit Score:Lenders may consider the personal credit score of the business owner when evaluating the eligibility for a business line of credit. A higher credit score indicates a lower risk and may increase the chances of approval.

Credit History: Lenders may also assess the credit history of the business owner to determine their ability to manage and repay debts. A positive credit history with timely payments and no defaults can improve eligibility.

Business Plan and Financial Projections

Business Plan:A comprehensive business plan that outlines the goals, financial projections, and strategies for growth can demonstrate the viability of the business and increase eligibility.

Financial Projections: Lenders may require financial projections, such as revenue forecasts and cash flow projections, to assess the future financial performance of the business. Accurate and realistic projections can enhance eligibility.

It is important to note that eligibility criteria may vary among different lenders, so it is recommended to research and compare multiple lenders to find the best fit for your new business.

Comments

Post a Comment