I. Introduction

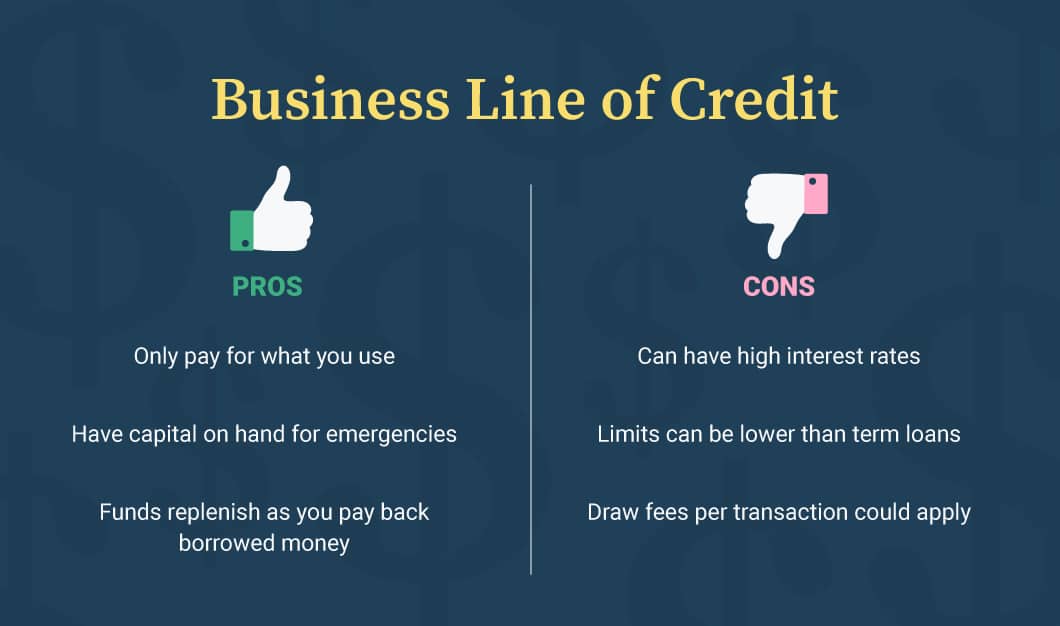

Starting and running a business requires careful financial planning and management. One important financial tool that businesses can utilize is a business line of credit. This type of funding provides businesses with access to a predetermined amount of money that can be utilized for various purposes, such as funding inventory, covering operating expenses, or managing cash flow.

Understanding Business Line of Credit

A business line of credit is a flexible form of financing that allows businesses to borrow money up to a predetermined credit limit. The business can draw funds from the line of credit as needed and only pay interest on the amount borrowed. The borrowed funds can be repaid and borrowed again, similar to a credit card. This type of financing provides businesses with the flexibility to manage their cash flow and address short-term financial needs.

Importance of Calculating Interest Only Payments

Calculating interest only payments on a business line of credit is crucial for proper financial planning. By understanding the amount of interest that will be accrued based on the borrowed amount, businesses can:

- Determine the affordability of the interest payments within their budget.

- Evaluate the cost of borrowing against the benefits it will provide.

- Plan for additional repayment strategies.

- Make informed decisions on the amount to borrow and the repayment timeline.

By utilizing a business line of credit calculator, businesses can easily assess the interest-only payments and make informed decisions about their financing options. This enables them to effectively manage their cash flow and ensure the sustainability and growth of their business.

II. What is a Business Line of Credit Calculator?

A Business Line of Credit Calculator is a helpful tool that allows business owners to calculate the interest only payments on a business line of credit. It helps determine the amount of interest that will be paid on the borrowed funds and gives an estimate of the total cost of the line of credit. This calculator is particularly useful for businesses looking to manage their cash flow and budget for the interest payments on their line of credit.

Explanation of Business Line of Credit Calculator

The calculator takes into account the principal amount borrowed, the interest rate on the line of credit, and the repayment term. It then calculates the monthly interest-only payments that need to be made during the term of the line of credit. This information gives business owners a clear understanding of the financial commitment they will be making when taking out a line of credit.

How to Use a Business Line of Credit Calculator

Using a Business Line of Credit Calculator is quick and straightforward. Just follow these steps:

Enter the principal amount borrowed: This is the total amount of money you plan to borrow using the line of credit.

Enter the interest rate: This is the annual interest rate at which the line of credit will be charged.

Enter the repayment term: This is the length of time, usually in months, over which you plan to repay the line of credit.

Click the calculate button: The calculator will then provide you with the monthly interest-only payment amount.

By using a Business Line of Credit Calculator, business owners can make informed decisions about their financial options and understand the costs associated with borrowing on a line of credit. It is a valuable tool for managing cash flow and planning for interest payments on a business line of credit.

III. Factors to Consider in Calculating Interest Only Payments

When calculating interest only payments for a business line of credit, there are several factors to consider. These factors will help determine the cost and the total amount that needs to be repaid. Here are the main factors:

Loan Principal Amount

The loan principal amount refers to the initial amount of money borrowed. This amount will have an impact on the interest charged and the overall repayment amount. The larger the loan principal amount, the higher the interest payments will be.

Interest Rate

The interest rate is the percentage charged on the loan principal amount. It is an important factor in calculating interest only payments. A higher interest rate will result in higher interest payments. It's essential to consider the interest rate when evaluating the cost of the line of credit.

Loan Term

The loan term refers to the period of time over which the loan is repaid. The longer the loan term, the more interest payments will be made. It's important to consider the loan term when calculating interest only payments and determining the total cost of the line of credit.

By considering these factors, businesses can better understand the cost and financial impact of an interest-only line of credit. It's crucial to carefully evaluate these factors and use a business line of credit calculator to determine the most suitable option for your needs.

IV. Benefits of Interest Only Payments

Interest-only payments for a business line of credit can offer several advantages compared to traditional repayment methods. Here are the key benefits to consider:

1. Lower Monthly Payments

2. Flexible Repayment Options

With interest-only payments, you have more flexibility in managing your cash flow and can focus on other business needs. You can allocate the saved money towards investing in growth opportunities, purchasing inventory, or covering other expenses important to your business.

By taking advantage of interest-only payments, you can ease the financial burden on your business, increase flexibility, and have the freedom to invest in its growth and success.

Comments

Post a Comment