I. Introduction

Overview of Business Line of Credit

In today's competitive business world, having access to flexible financing options is crucial for the growth and success of your business. One such financing option is a business line of credit, which provides a revolving credit line that can be used for various business needs.

A business line of credit allows you to borrow funds up to a predetermined limit, and you only pay interest on the amount you actually use. It is a flexible form of financing that can help you manage cash flow fluctuations, seize business opportunities, and cover unexpected expenses.

Key benefits of a business line of credit include:

- Flexibility: You have the freedom to borrow and repay funds as needed, which provides you with greater control over your finances.

- Convenience: Once your line of credit is approved, funds can be accessed quickly and easily, making it a convenient financing option for urgent needs.

- Cost-effectiveness: Compared to other forms of financing, such as loans, a line of credit typically offers lower interest rates, resulting in potentially lower borrowing costs.

- Build Credit: Consistently using and repaying your line of credit can help build your business's credit profile, which may lead to more favorable financing terms in the future.

A business line of credit can be a valuable tool for businesses of all sizes and industries. Whether you need to bridge gaps in cash flow, invest in new equipment, or fund marketing initiatives, a business line of credit can provide the financial flexibility you need to succeed.

II. Importance of Business Line of Credit

Why Do You Need a Business Line of Credit?

A business line of credit is a valuable financial tool that can provide your business with the flexibility and stability it needs to thrive. Whether you are just starting a new venture or looking to expand an existing one, having access to a business line of credit in Canada can offer several benefits:

1. Financial Cushion: A business line of credit serves as a safety net that can help your business navigate through unforeseen expenses, cash flow gaps, or emergencies. It provides you with the peace of mind that you have access to funds when you need them, avoiding potential disruptions in your business operations.

2. Working Capital Flexibility: With a business line of credit, you have the flexibility to use the funds for various purposes, such as purchasing inventory, covering payroll, or investing in equipment. It allows you to manage your working capital effectively and seize opportunities for growth as they arise.

3. Cash Flow Management: One of the biggest challenges for small businesses is managing cash flow. A business line of credit can help you bridge the gap between payables and receivables by providing immediate access to funds. It ensures that you can meet your financial obligations and maintain a healthy cash flow.

4. Building Credit Worthiness: By responsibly using and repaying your business line of credit, you can establish a solid credit history for your business. This can enhance your business's credibility and increase your chances of securing additional financing in the future.

5. Seasonal or Cyclical Expenses: For businesses that experience seasonal fluctuations in revenue or cyclical expenses, a business line of credit can be a lifeline. It allows you to access funds during slower periods or when expenses are higher, ensuring that your business can continue to operate smoothly.

By understanding the importance of a business line of credit and leveraging it effectively, you can strengthen your financial position and position your business for long-term success. Remember to choose a lender that offers favorable terms and conditions that align with your business's needs and goals.

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

III. Eligibility and Requirements

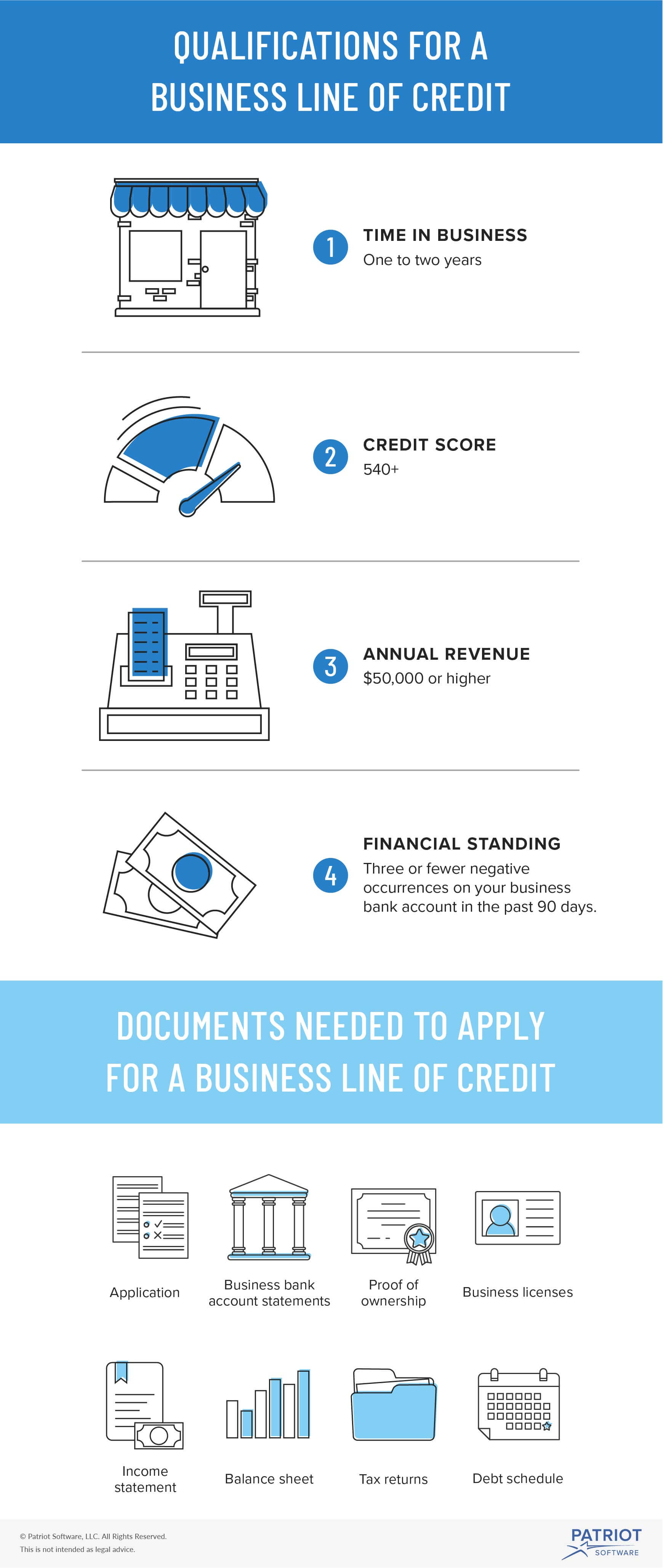

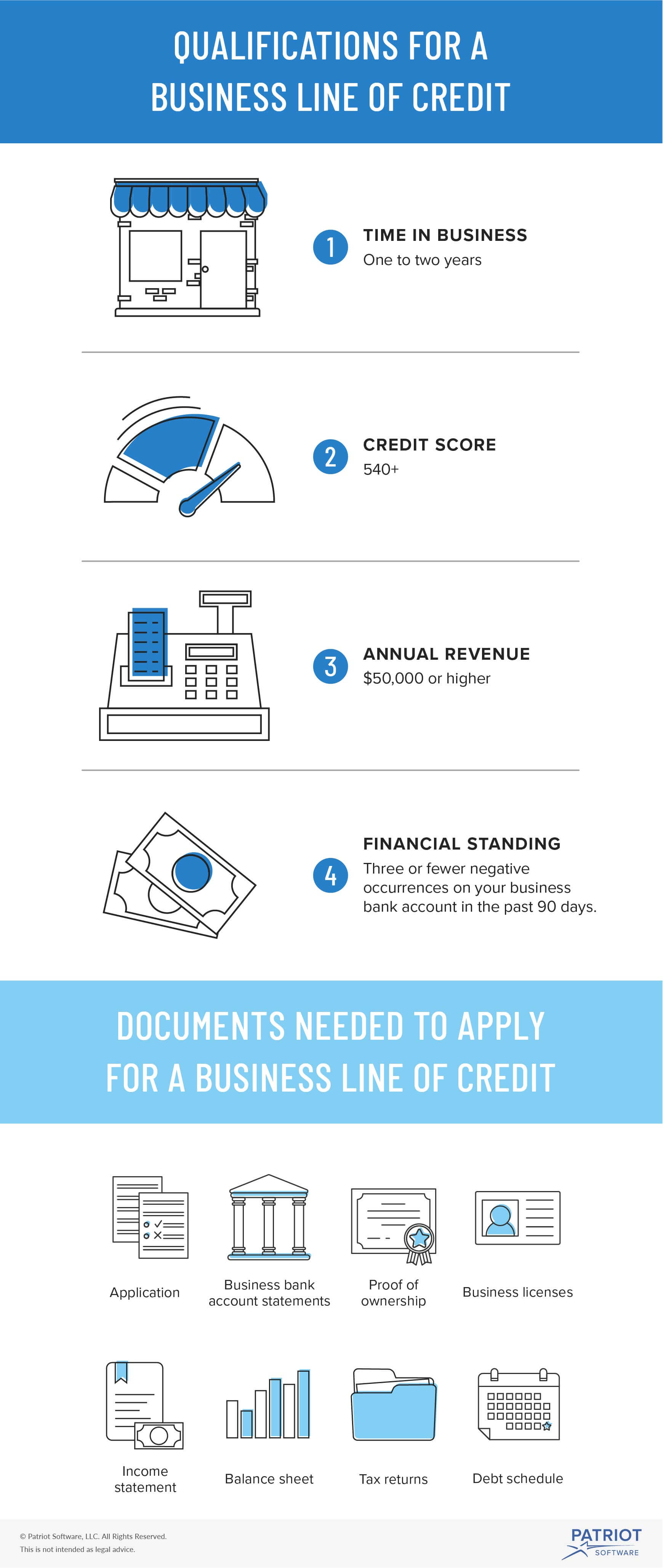

When applying for a business line of credit in Canada, there are certain eligibility criteria and requirements that you need to meet. These criteria ensure that you are a suitable candidate for receiving a line of credit and help the lender assess your creditworthiness. Here are the qualification criteria and documents required for a business line of credit application in Canada:

Qualification Criteria for Business Line of Credit in Canada

To qualify for a business line of credit in Canada, you typically need to meet the following criteria:

- Credit Score: Lenders usually require a minimum credit score of 650 or higher to consider your application.

- Business Age: Your business should have a minimum operating history of at least 1-2 years.

- Revenue: Lenders will look at your business's annual revenue to determine your repayment capacity.

- Profitability: Your business should be profitable or show a positive cash flow.

- Collateral: Depending on the lender, collateral may be required to secure the line of credit.

It's important to note that each lender may have slightly different qualification criteria, so it's crucial to check with the specific institution you are applying to.

Documents Required for Business Line of Credit Application

When applying for a business line of credit, you will typically need to submit the following documents:

- Business Plan: A well-developed business plan that outlines your company's objectives and financial projections.

- Financial Statements: This includes your business's balance sheet, income statement, and cash flow statement.

- Personal Identification: A valid government-issued ID for all business owners and authorized signatories.

- Bank Statements: Recent bank statements to provide a snapshot of your business's cash flow.

- Income Tax Returns: Personal and business income tax returns for the past 2-3 years.

These are just a few of the documents that may be required, and additional documentation may vary depending on the lender. It's recommended to contact the lender or consult their website to get a comprehensive list of required documents.

Providing all the necessary documents accurately and on time will increase your chances of approval for a business line of credit in Canada.

Comments

Post a Comment