I. Introduction

If you're a business owner, you may have heard about the concept of a business line of credit. It's a valuable financial tool that can provide your business with flexibility and quick access to funds when needed. In this section, we'll discuss what a business line of credit is, why it's important, and how you can benefit from having one.

What is a business line of credit?

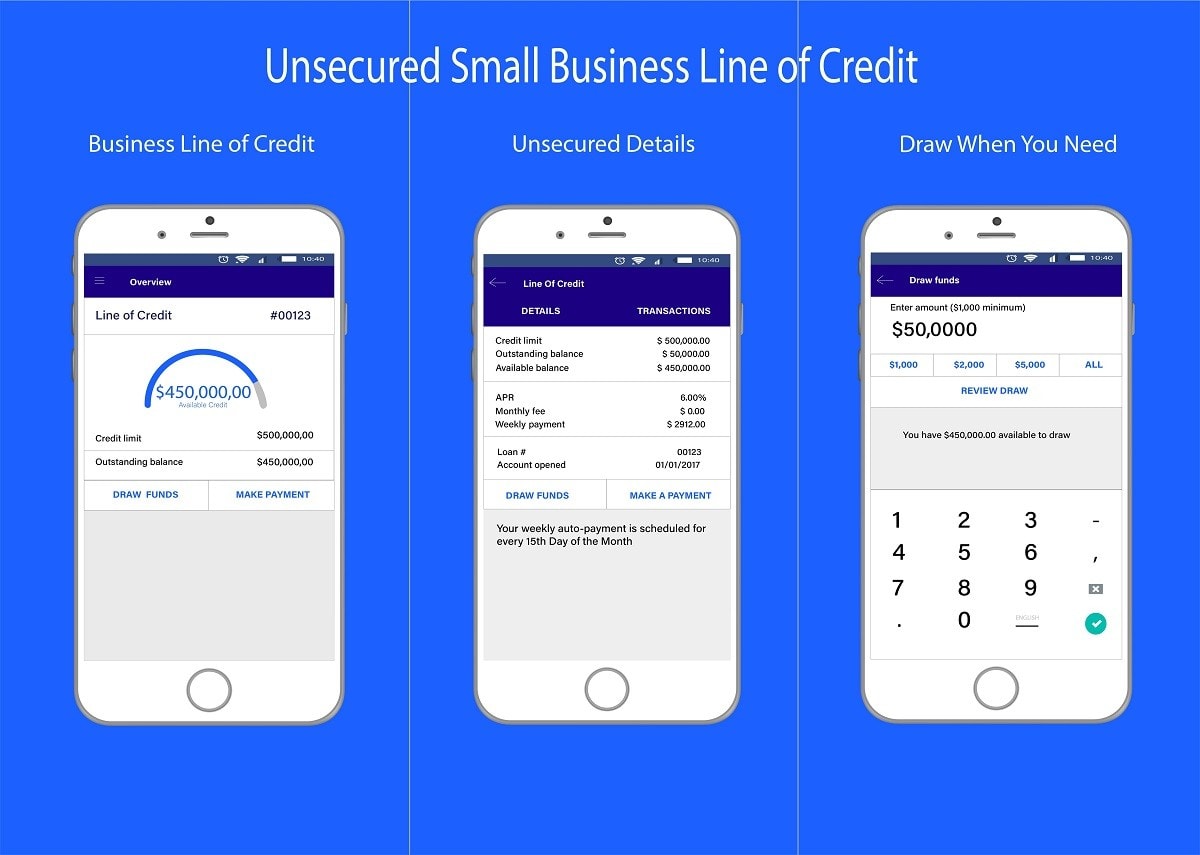

A business line of credit is a type of financing that allows businesses to access funds up to a predetermined credit limit. It's similar to a credit card, where you have a set amount of money available to borrow, but you only pay interest on the amount you actually use. Once you repay the borrowed amount, your credit line replenishes, and you can use it again.

Why is a business line of credit important?

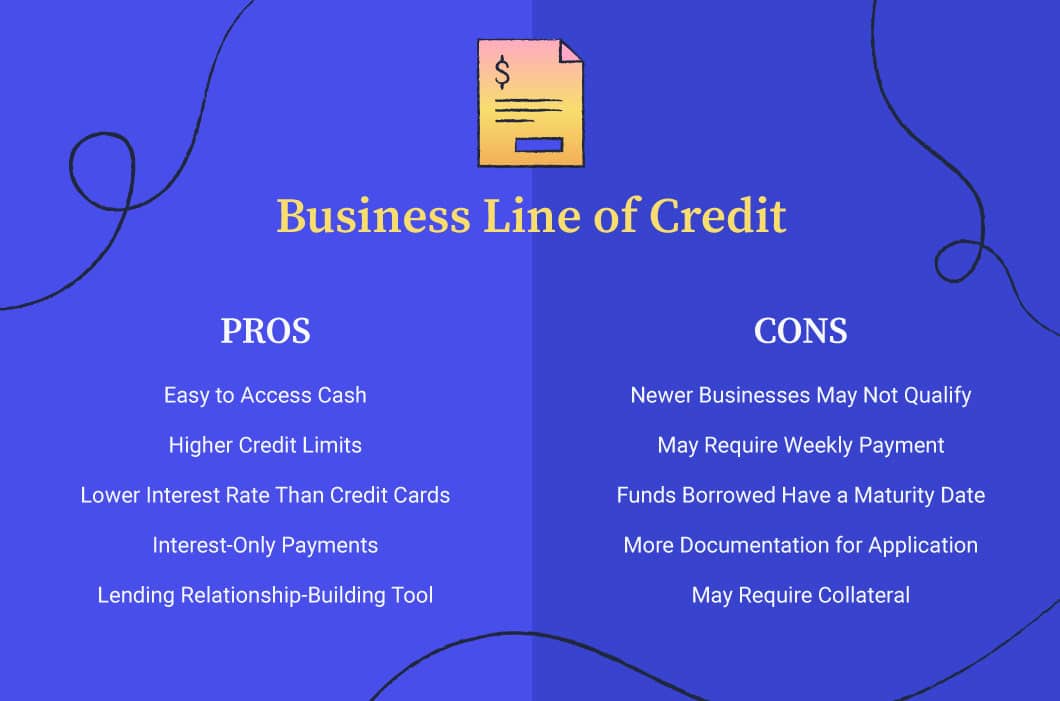

Having a business line of credit can provide several benefits for your business:

Flexibility: A business line of credit gives you the freedom to use funds for various business needs, such as managing cash flow, purchasing inventory, or covering unexpected expenses.

Quick access to funds: Unlike traditional loans, which may have a lengthy approval process, a business line of credit allows you to access funds quickly, providing you with the agility to seize opportunities or handle emergencies.

Cost-effective: With a line of credit, you only pay interest on the amount you borrow, making it a cost-effective financing option compared to other types of loans.

Build business credit: Successfully managing a business line of credit can help you establish and improve your business credit score, making it easier to access larger amounts of credit in the future.

In the next sections, we'll explore how to qualify for a business line of credit, tips for managing your credit line effectively, and important considerations to keep in mind. Stay tuned for more information on harnessing the power of a business line of credit to support your business growth and financial stability.

II. Understanding Business Credit

When it comes to securing financing for your business, having a strong business credit score can significantly increase your chances of getting approved for a business line of credit. Business credit is a measure of your company's creditworthiness and its ability to repay borrowed funds. Here are some factors that can affect your business credit and tips on how to improve your business credit score:

Factors that affect business credit

Payment history: Your repayment history plays a crucial role in determining your business credit score. Make sure to pay your bills on time, including loans, credit card payments, and vendor payments.

Credit utilization: The percentage of credit you use compared to your total available credit can impact your business credit score. It's advisable to keep your credit utilization below 30% to demonstrate responsible credit management.

Length of credit history: The age of your business credit accounts is an essential factor in determining your creditworthiness. The longer your credit history, the better it reflects your ability to manage credit responsibly.

Public records: Bankruptcies, liens, and other legal actions can negatively impact your business credit score. It's crucial to stay on top of your financial obligations and address any issues promptly.

How to improve your business credit score

Pay bills on time: Consistently making on-time payments is one of the most effective ways to improve your business credit score. Set reminders, automate payments, or create a system to ensure timely bill payments.

Reduce credit utilization: Aim to keep your credit utilization below 30%. If you're currently using a high percentage of your available credit, develop a plan to pay down debt and reduce your credit utilization ratio.

Monitor your credit report: Regularly review your business credit reports from credit bureaus such as Experian, Equifax, and Dun & Bradstreet. Look for inaccuracies or discrepancies that could be negatively impacting your credit score and address them promptly.

Establish trade lines: Building positive relationships with suppliers and vendors can help establish trade lines that contribute to your business credit profile. Ensure that these suppliers report your payment history to business credit bureaus.

By understanding the factors that affect business credit and taking steps to improve your credit score, you can increase the likelihood of getting approved for a business line of credit. Keep in mind that building strong business credit takes time and consistent effort, but the benefits are well worth it.

Comments

Post a Comment