I. Introduction

Starting a new business can be an exciting venture, but it also comes with its fair share of financial challenges. One of the key aspects of managing and growing a new business is having access to adequate funding. This is where a business line of credit can make a significant difference.

Understanding the importance of a business line of credit

A business line of credit is a flexible financing option that allows businesses to access funds as needed, up to a predetermined credit limit. Unlike traditional loans, where you receive a lump sum upfront, a line of credit provides you with ongoing access to funds that you can draw on whenever necessary. A business line of credit can be used for various purposes, such as managing cash flow, making inventory purchases, covering unexpected expenses, or taking advantage of growth opportunities.

Key benefits of having a business line of credit

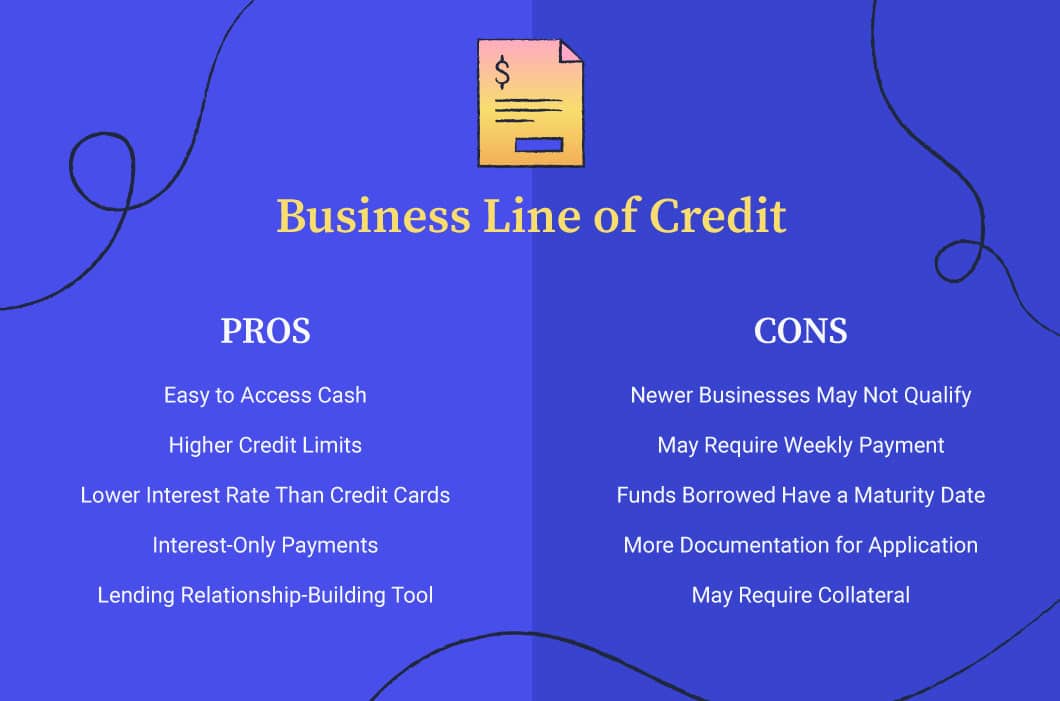

Having a business line of credit can provide several advantages for a new business, including:

1. Flexibility: A line of credit gives you the freedom to access funds only when you need them, rather than borrowing a larger amount all at once.

2. Financial Stability: With a line of credit in place, you can better manage your cash flow and ensure that you have funds available to cover unexpected expenses or financial gaps.

3. Building Business Credit: Utilizing a line of credit responsibly and making timely payments can help you establish and improve your business credit score, which can be crucial for future financing needs.

4. Lower Interest Costs: Compared to other forms of financing such as credit cards, business lines of credit often have lower interest rates, making them a more cost-effective option for accessing funds.

5. Growth Opportunities: A business line of credit can provide the necessary capital to seize growth opportunities, such as expanding your product line, entering new markets, or launching marketing campaigns.

In the next sections, we will explore the steps involved in obtaining a business line of credit and provide some tips to increase your chances of approval. Stay tuned for valuable insights on how to secure the financing your new business needs to thrive.

II. Understanding Business Credit

When starting a new business, it's important to understand the difference between personal and business credit. Building a strong business credit profile can help you secure a business line of credit and other financing options. Here are some key points to consider:

Difference between personal and business credit:

- Personal credit is based on your personal financial history and is separate from your business credit.

- Business credit is based on your business's financial history and is tied to your business's Employer Identification Number (EIN).

- Keeping personal and business finances separate is crucial to building a strong business credit profile.

Building a strong business credit profile:

To build a strong business credit profile, follow these steps:

Establish your business as a separate legal entity: Form an LLC or incorporate your business to create a clear separation between personal and business finances.

Obtain an EIN: Apply for an Employer Identification Number (EIN) from the IRS. This unique identifier is used to track your business's credit activity.

Open a business bank account: Open a separate bank account for your business to keep personal and business finances separate.

Register with business credit bureaus: Register your business with business credit bureaus like Dun & Bradstreet, Experian, and Equifax to start building your business credit history.

Make timely payments: Pay your business bills and debts on time to establish a positive payment history.

Remember to consistently monitor your business credit profile and maintain good financial habits to improve your chances of getting a business line of credit for your new business.

III. Finding the Right Lender

When looking for a business line of credit for your new business, finding the right lender is crucial. Here are a few steps you can take to find a reputable lender that meets your business needs:

Researching reputable lenders

- Start by conducting thorough research on different lenders in your area. Look for lenders that specialize in providing business lines of credit to new businesses.

- Read reviews and testimonials from other business owners who have worked with these lenders. This will give you an idea of their reputation and customer satisfaction levels.

- Check the lender's accreditation and credentials. Make sure they are licensed and registered with the appropriate regulatory bodies.

- Look for lenders that have experience working with businesses in your industry. They will have a better understanding of your unique financing needs.

- Consider working with lenders that offer additional resources and support for new businesses, such as workshops, mentoring programs, or networking opportunities.

Factors to consider when choosing a lender

- Interest rates and fees: Compare the interest rates and fees charged by different lenders to ensure you're getting the best deal.

- Repayment terms: Consider the repayment terms offered by each lender. Look for flexible repayment options that align with your cash flow.

- Eligibility requirements: Review the lender's eligibility criteria to determine if you meet their requirements. Different lenders may have different criteria, so it's important to find one that suits your situation.

- Customer service: Pay attention to the level of customer service provided by each lender. A responsive and helpful team can make a big difference in your borrowing experience.

- Long-term relationship: If you foresee needing additional financing in the future, consider building a long-term relationship with a lender that provides other types of business loans.

By taking the time to research reputable lenders and considering these factors, you can find the right lender for your new business line of credit. This will ensure that you have the financial support you need to grow and succeed.

Comments

Post a Comment