I. Introduction

Starting a new business can be an exciting endeavor, but it often comes with financial challenges. One of the biggest hurdles for new businesses is accessing credit. Without a proven track record or revenue to show, it can be difficult to secure a traditional loan. However, there is an alternative solution that can help new businesses bridge the gap and cover expenses: a business line of credit.

Understanding Business Line of Credit for New Businesses

A business line of credit is a type of financing that provides entrepreneurs with access to a predetermined amount of money that they can borrow as needed. Unlike a traditional loan, where the full amount is disbursed upfront, a line of credit allows business owners to withdraw funds when necessary and only pay interest on the amount borrowed.

With a line of credit, new businesses can:

- Cover operating expenses during the early stages

- Purchase inventory or equipment

- Fund marketing and advertising campaigns

- Manage cash flow fluctuations

Importance of Accessing Credit for New Businesses

Access to credit is crucial for new businesses, as it can provide the financial stability needed to survive and thrive. Here are a few reasons why accessing credit is important for new businesses:

Flexibility: A business line of credit offers flexibility, allowing entrepreneurs to use the funds as needed and tailor their borrowing to the specific demands of their business.

Building Credit History: By responsibly using a line of credit, new businesses can establish a positive credit history, which can benefit them in the future when considering larger loans or other forms of financing.

Managing Cash Flow: Cash flow management is a common challenge for new businesses. A line of credit can help bridge gaps between revenue fluctuations, ensuring that businesses have enough funds to cover expenses.

Growth Opportunities: With access to credit, new businesses can seize growth opportunities and invest in areas that will help them scale and expand.

Overall, a business line of credit can be a lifeline for new businesses with no revenue, providing them with the financial support to get off the ground and navigate the early stages of entrepreneurship. It is important for new business owners to explore their options and find a lender that understands their unique needs and challenges.

II. What is a Business Line of Credit?

Definition and Purpose of a Business Line of Credit

A business line of credit is a flexible financing option that provides businesses with access to funds on an as-needed basis. It is a revolving line of credit, meaning that business owners can borrow and repay funds repeatedly. The purpose of a business line of credit is to provide businesses with the necessary working capital to manage cash flow fluctuations, support growth initiatives, and cover unexpected expenses. Unlike traditional loans, where borrowers receive a lump sum of money upfront, a business line of credit allows businesses to draw funds only when needed, reducing interest costs.

Key Features and Benefits

Key features:

- Flexibility: Business owners have the flexibility to borrow and repay funds based on their needs, allowing them to effectively manage their cash flow.

- Revolving: As funds are repaid, they become available for borrowing again, making it a renewable source of credit.

- Variable interest rates: The interest rates for a business line of credit are usually variable, meaning they can fluctuate over time.

Benefits:

- Access to capital: A business line of credit provides businesses with quick access to funds, which can be crucial for covering expenses or seizing new opportunities.

- Cost-effective: Businesses only pay interest on the amount borrowed, providing cost savings compared to traditional loans.

- Improved cash flow management: By having a line of credit in place, businesses can better manage cash flow fluctuations and avoid cash shortages.

A business line of credit can be especially beneficial for new businesses with no revenue, as it provides them with a financial lifeline during the early stages of growth. It allows new businesses to cover initial expenses, invest in marketing and inventory, and navigate through the challenges of starting a business.

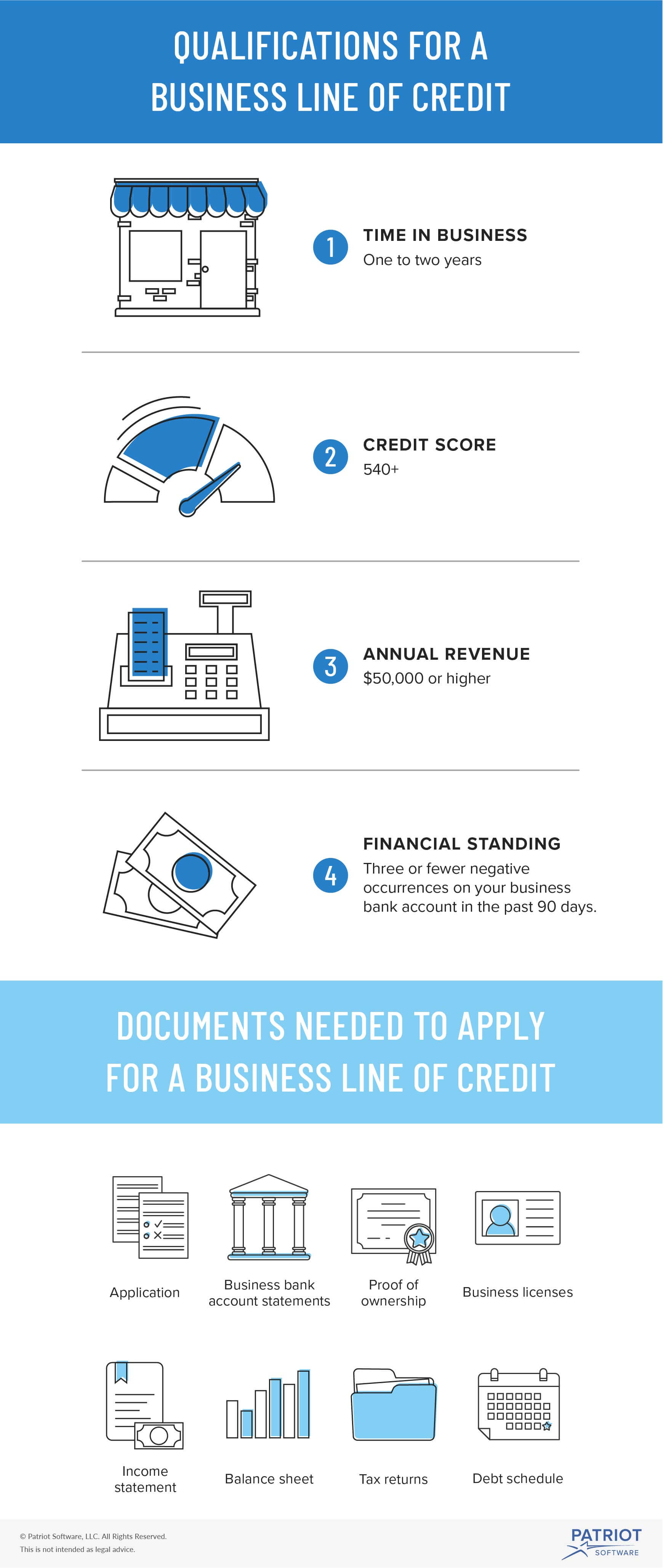

III. How to Qualify for a Business Line of Credit as a New Business?

If you are a new business with no revenue, getting approved for a traditional business line of credit can be challenging. Lenders typically require a track record of revenue and financial stability before extending credit. However, there are alternative ways to showcase your creditworthiness and increase your chances of qualifying for a business line of credit. Here are some strategies to consider:

1. Personal Credit Score

- Providing a strong personal credit score can help lenders gauge your creditworthiness as a business owner. - Maintaining a good personal credit history, paying bills on time, and keeping credit card balances low can improve your chances of approval.2. Collateral

- Offering collateral can provide lenders with additional security and increase your chances of securing a business line of credit. - Collateral can include personal or business assets such as property, equipment, or inventory.3. Business Plan

- Creating a comprehensive business plan that highlights your industry knowledge, market analysis, and growth projections can demonstrate your ability to generate revenue in the future.4. Vendor Credit

- Establishing relationships with vendors and suppliers who offer trade credit can help you build a positive credit history. - Making timely payments to vendors can help establish your business's creditworthiness.It's important to note that each lender may have different criteria and requirements for extending credit to new businesses. Researching and comparing different lenders can help you find one that aligns with your specific needs and circumstances.

Comments

Post a Comment