In the world of business financing, having access to a line of credit can be a game-changer. And when it comes to finding the right solution, Wells Fargo is a name that often comes to mind. But before diving into the details, it's important to understand how a business line of credit works and what it can do for your company. That's where the Wells Fargo business line of credit calculator comes in. With this tool, you can estimate your monthly payments and get a clearer picture of how much credit you may be eligible for. In this blog post, we'll explore the features and benefits of a business line of credit from Wells Fargo and how their calculator can help you make informed financial decisions. So, let's get started and uncover the possibilities that await your business!

I. Understanding Business Line of Credit

Overview of Business Line of Credit

A Business Line of Credit is a flexible financing solution that provides businesses with access to a predetermined amount of funds that can be used for various purposes, such as managing cash flow, covering unexpected expenses, or taking advantage of growth opportunities. Unlike a traditional loan, a line of credit allows businesses to withdraw funds as needed and only pay interest on the amount borrowed. This makes it a valuable tool for businesses that have fluctuating cash flow or ongoing funding needs. With a business line of credit, you can have peace of mind knowing that you have access to funds whenever you need them, without having to go through the process of applying for a loan each time.

Benefits of Business Line of Credit

A business line of credit offers several benefits for small businesses, including:

Flexibility: A line of credit provides businesses with access to funds that can be used for various purposes, such as managing cash flow, purchasing inventory, or covering unexpected expenses.

Borrowing Capacity: With a line of credit, businesses have the flexibility to borrow up to a certain limit, allowing them to access funds as needed without having to reapply for a loan each time.

Cost-effective: Unlike a traditional loan, businesses are only charged interest on the amount they borrow from the line of credit, making it a cost-effective financing option.

Emergency Funds: A line of credit acts as a safety net, providing businesses with a source of emergency funds in case of unforeseen circumstances or opportunities that require quick access to capital.

Establishing Creditworthiness: Timely repayment and responsible use of a business line of credit can help establish and improve a business's creditworthiness, making it easier to qualify for future financing.

Overall, a business line of credit offers flexibility, convenience, and a safety net for small businesses, making it a valuable financing tool.

II. Wells Fargo Business Line of Credit

Introduction to Wells Fargo

Wells Fargo is a well-established and reputable financial institution that offers a variety of banking services, including a business line of credit. With a long history of serving businesses of all sizes, Wells Fargo provides a reliable and trusted option for obtaining a line of credit. Their business line of credit offers numerous features and benefits that can help businesses manage their cash flow and fund their growth initiatives. Whether you're a small startup or an established company, Wells Fargo's business line of credit can provide the financial support you need to achieve your business goals.

Here are some of the features and benefits of Wells Fargo's business line of credit:

- Flexible credit limits: Wells Fargo offers business lines of credit with varying credit limits, allowing you to access the funds you need based on your business's specific needs.

- Competitive interest rates: Wells Fargo provides competitive interest rates on their business lines of credit, helping you save money on interest payments over time.

- Quick access to funds: Once approved, you can access your line of credit quickly and easily, providing you with the flexibility to address immediate cash flow needs.

- Convenience and ease of use: Wells Fargo offers online banking and mobile banking options, making it simple and convenient to manage your business line of credit and track your account activity.

With its strong reputation and comprehensive suite of financial services, Wells Fargo is a reliable choice for businesses seeking a business line of credit. Their extensive experience in serving businesses of all sizes makes them a trusted partner in helping you achieve your financial goals.

Features and Benefits of Wells Fargo Business Line of Credit

Wells Fargo offers a variety of features and benefits with their Business Line of Credit. Some of the key features include:

- Flexible borrowing: You have access to a set credit limit and can borrow as much or as little as you need within that limit.

- Revolving credit: As you repay the borrowed amount, it becomes available for you to borrow again, providing ongoing access to funds.

- Competitive interest rates: Wells Fargo offers competitive interest rates, helping you save money on interest payments.

- Customizable repayment terms: You can choose the repayment terms that best fit your business's cash flow, giving you greater control over your finances.

- Online and mobile banking: Manage your Business Line of Credit conveniently through Wells Fargo's online and mobile banking platforms.

These features provide businesses with the flexibility and financial support they need to manage cash flow, cover unexpected expenses, and seize growth opportunities.

III. How to Qualify for a Business Line of Credit

Requirements for Wells Fargo Business Line of Credit

To qualify for a Wells Fargo Business Line of Credit, there are certain requirements you must meet. These include having a strong credit score and a solid financial history. Wells Fargo typically requires a minimum credit score of 620 for business owners. Additionally, they will consider your business financials, such as revenue and cash flow, to assess your ability to repay the credit line. It's also important to have a well-developed business plan and any necessary collateral that may be required. Meeting these requirements increases your chances of securing a business line of credit from Wells Fargo.

Credit Score and Financial History

When it comes to qualifying for a business line of credit, your credit score and financial history are important factors that lenders consider. A higher credit score demonstrates your ability to manage debt and make timely payments, increasing your chances of approval. Lenders also review your financial history, including your business's revenue, profitability, and any outstanding debts. Having a strong credit score and positive financial history can help you secure a business line of credit with favorable terms and conditions.

Here are some key points to consider:

- Maintain a good personal and business credit score to demonstrate financial responsibility.

- Keep a low debt-to-income ratio to show that you can manage your existing debts effectively.

- Pay bills and loans on time to avoid any negative marks on your credit history.

- Provide accurate and up-to-date financial statements and tax returns to showcase your business's financial health.

- Minimize outstanding debts or resolve any outstanding issues to improve your creditworthiness.

By understanding the importance of your credit score and financial history, you can take steps to strengthen them and increase your chances of qualifying for a business line of credit.

IV. Wells Fargo Business Line of Credit Calculator

Importance of Business Line of Credit Calculator

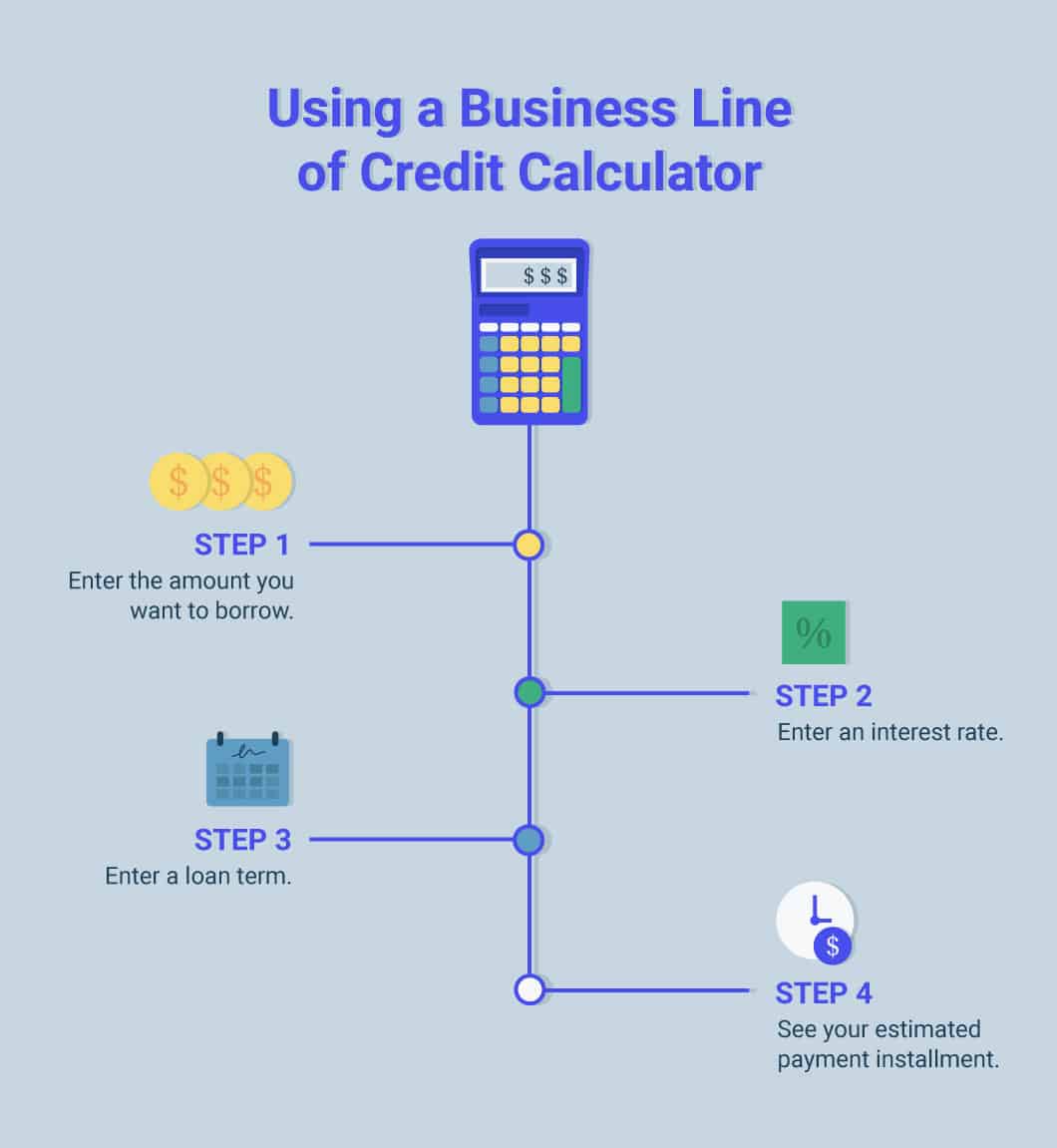

Having access to a business line of credit calculator is crucial for entrepreneurs and small business owners. It allows you to determine the amount you can borrow, estimate monthly payments, and compare different options. Wells Fargo's business line of credit calculator is a valuable tool that provides transparency and helps you make informed financial decisions for your business. By inputting the desired loan amount, interest rate, and repayment term, you can quickly see the estimated monthly payment and total repayment amount. This allows you to evaluate if the terms are feasible for your business and compare different loan options to find the best fit. With the help of a business line of credit calculator, you can plan your finances effectively and ensure that your business remains financially stable.

How to Use Wells Fargo's Business Line of Credit Calculator

Using Wells Fargo's Business Line of Credit calculator is straightforward. Simply input the required information, such as the desired credit amount and repayment term. The calculator will then generate an estimate of the monthly payment based on the current interest rates and fees applicable to Wells Fargo's Business Line of Credit. This tool allows you to easily compare different loan options and determine which terms and rates work best for your business's financial needs.

V. Factors to Consider

Interest Rates and Fees

When considering a business line of credit from Wells Fargo, it’s important to understand the interest rates and fees associated with this financing option. Wells Fargo offers competitive rates and fees, allowing businesses to access the funds they need while keeping costs manageable.

Key factors to consider include:

Interest Rates: Wells Fargo offers both variable and fixed interest rates for their business line of credit. Variable rates can fluctuate over time, while fixed rates provide stability and predictable monthly payments.

Fees: Wells Fargo may charge various fees, such as an annual fee or origination fee, for accessing and maintaining a business line of credit. These fees can vary depending on the specific terms and amount of credit requested.

It's important to review the terms and conditions of Wells Fargo's business line of credit to fully understand the interest rates and fees associated with this financing solution. This will help you make an informed decision and ensure that the line of credit aligns with your business's financial goals and requirements.

Comments

Post a Comment